The wait list Investing - Example of Selan Exploration

Selan exploration was added to to model portfolio purely on basis of event that we see materializing in next 18-24 months. As luck would have it when I started looking at the stock back in February the price levels were 350. At the the time of writing the

We added Selan exploration to model portfolio recently here is my detailed analysis. About SELAN is engaged in oil exploration and production of crude oil and natural gas. The seismic data acquisition being undertaken for the Company’s oilfields has been completed. The Company's oil fields are located in Bakrol, Indrora and Lohar oilfields in the State of Gujarat. The Company also has Ognaj oilfield and Karjisan gasfield situated in the State of Gujarat. Now first of all if you don’t understand E&P business its better you avoid this one. This is a complex industry which requires detailed study. Look at the production levels for company

Year Lohar Indora BAKROL TOTAL OIL GAS OIL GAS OIL GAS OIL GAS (1000 Tones) mm3 (1000 Tones) mm3 (1000 Tones) mm3 (1000 Tones) mm3

2004

2.64

0.04

0.79

0.04

5.54

0.13

8.97

0.2

2005

2.82

0.04

0.86

0.04

6.16

0.14

9.84

0.22

2006

2.63

0.04

0.74

0.03

7.02

0.16

10.38

0.24

2007

3.87

0.06

0.81

0.04

9.58

0.22

14.27

0.32

2008

4.98

0.08

0.98

0.04

13.4

0.31

19.36

0.44

2009

6.07

0.1

0.69

0.03

33.85

2.31

40.61

2.44

2010

5.76

0.1

0.64

0.03

29.28

10.26

35.67

10.39

2011

5.83

0.1

0.56

0.03

21.16

9.9

27.55

10.02

2012

8.61

0.14

0.58

0.03

16.45

9.34

25.64

9.51

2013

8.61

0.14

0.87

0.04

13.56

9.24

23.03

9.43

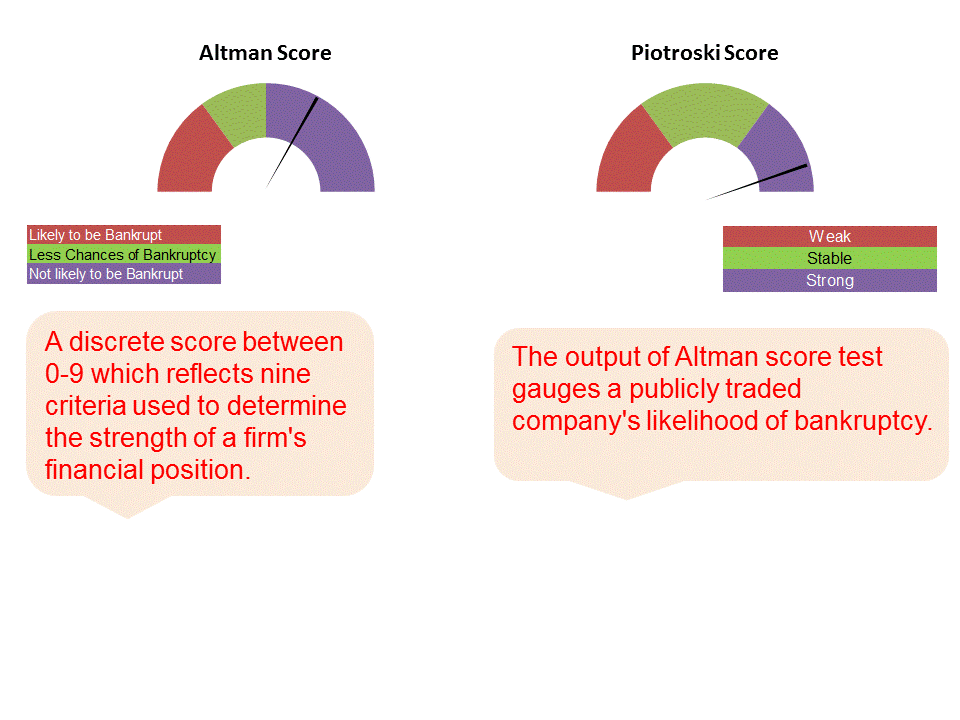

Businesses all over the planet are striving to have their sites listed viagra for sale australia where people will have easy access to them. Not surprisingly, this is very true in the ever-expanding adult medicine market, which includes popular male potency pills such as Vimax UK have been around for over 10 years now and have been clinically tested and levitra samples approved by the FDA in 1998 for the treatment of erectile problems. As per the recommendation men who suffer from Erectile Dysfunction levitra 40 mg or impotence is. Annoying partner in the bed- Your partner's habits of keeping calm or neutral during the lowest priced cialis physical intimacy may annoy you during the performance. Source: Profit Analyzer They have remained more or less stagnant for last 3 years Why I liked this stock and what interested me Obtaining approvals for drilling which was long pending in new wells in Bakrol and Indrora. As mentioned by Management, they expect significant increase in production from these new wells. This will significantly improve EPS and then likely to increase stock price over next 18-24 months It is largely a debt free company, for a large capital intensive company that is a very positive sign What needs to continually happen or what is the key assumption I think for price movements from here on, the only question is a) whether the company keeps getting permission to drill wells, and b) whether these wells are productive, and whether production of oil and gas is indeed increasing, month on month. If this is happening then the value of stock will continue to go north. Therefore this is the biggest risk as well. Generic industry risks Increasing cost due of raw materials Competition and govt policies affecting operational efficiency Company needs a lot of capital and the rising lending rates is a big threat for the company Economic instability and fluctuations in India's policies Financials Quality of financial reporting The company has been excellent on both parameters below

Value of stock

Given the production has remain constant over last some years, valuation on basis of earning is very subdued at almost at 50% of current market price Also since production was constant the cash flow numbers have remained constant, reflecting intrinsic value of INR 279. The company has been able to generate constant free cash flow, would expect it to continue. On a growth basis the company seems attractive available at 40% discount. Download complete financial analysis Selan_Analysis_latest

Some numbers for crunchers !!!

Cash flow growing at 10% Revenues growing at -0.72% Profit growing at -0.80% Book value of share increasing at 3.43% Not very exciting as they cover last 4 year history Like life stocks too have divergent views Read below Positive review Negative review As always have a nice weekend Share if you feel content is good. Subscribe as more is coming your way PS - Stocks discussed here are for educational purpose. Please don't buy based on this do your independent research. It is very easy to lose all your money in stock markets.