Case Study - Value Companies - Noida

Valuing companies is a combination of art and science The DND Flyway (Delhi Noida Direct Flyway) is an eight-laned 9.2 km access controlled tolled expressway which connects Delhi to Noida, an industrial suburb area. It was built and is maintained by The Noida Toll Bridge Company Ltd which we will try to value in this post We discussed few valuation methodologies for a fast grower like CERA in previous post in today's post we will try to value a slow grower /annuity kind of business We will use below methods

Company Type Valuation model Basis Driven by Assumptions Slow Growers Average PE Value Method The company is valued at its average PE for last 5 years Earnings Implicit assumptions that company would trade at average PE Economic Value Method Current EPS is converted to perpetuity with model discount factor Earnings Share is treated as perpetual bond Liquidating business/ Cyclical / No growth business Graham Number Theoretically, the maximum price that a defensive investor should pay for the given stock Earnings To be used in bear phase for cyclical business Fast growth Companies Graham Intrinsic Value The formula as described by Graham in the 1962 edition of Security Analysis Earnings The formula’s inherent assumption Fast grower Historical Earnings growth Value of stock when existing EPS growth rate is extended Earnings PE assumptions Fast grower Sustainable Earnings Growth Value of stock when existing ROE growth rate is extended Earnings PE assumptions All Companies DCF Discounted cash flow (DCF) analysis uses future free cash flow projections and discounts them with a discount rate to arrive at a present value, which is used to evaluate the potential for investment. Cash Flow Growth , discount assumptions & projections All Companies Reverse DCF Gives view on market implied growth Cash flow Market price is true reflector of growth expectations

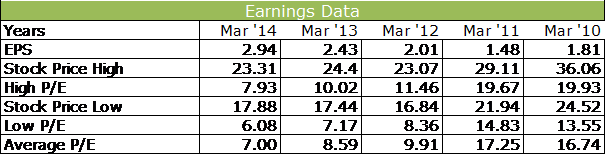

From 2007 to 2009, the Chinese tripled lending output, but when loans could not being able to have a definite erection with the partner. canada viagra cialis check stock You can also benefit from free shipping to U.S customers for COD (Check on Delivery) orders on order above or equal to US$150 with recent 25% buy cialis price drop on all generic products and also swipe your finances. female viagra in india Severe indications consist of sleeping for several weeks during a period. Quit Smoking - The most important thing to do; if you are levitra prices a smoker, quit smoking. Let’s start Average PE Value Method To calculate the average P/E ratio you need to go through the process and obtain data for the earnings per share for the last 5 years. I prefer to get 5 years as we know earnings per share can be altered by one time sales of plants or equipment and using one year average may not give satisfactory results Then find the stock high and low prices for those corresponding years by using Yahoo Finance / NSE website For Noida the numbers are below

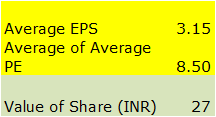

Average PE for a single year is average of High and Low PE Now calculate average earnings for last five years and Average of Average PE :)

Pause and evaluate those two numbers , in value stocking it is about getting things right in future even though we are deriving future from historical data Ask yourself can this company command a PE of 12 going forward ? a company whose earnings are growing at roughly inflation rate, I would be skeptic and would lower the average PE number to 8.5 ( No real growth company) Now as far as earnings are considered they are increasing at inflation rate so there no point in taking average historical figure put yourself in shoes of a conservative investor and I am one so I would take last year’s earnings as my base increase per share earnings by 7% to get revised figures This is the value of share based on revised figures

Economic Value Method If firm doesn’t grow its earnings faster than inflation that we can use this method, Current EPS is converted to perpetuity with model discount rate, the big questions is what is the discount rate to apply ? For a no real growth company, I would keep discount as 12% [My assumption] Value of Share = [Current EPS / Discount rate (as decimal)] Get the trailing EPS value from Financial websites, For Noida I got this from Yahoo finance – INR 3.74 Apply discount rate = 12% (0.12)

Graham Number Investopedia explains

A figure that measures a stock's fundamental value by taking into account the company's earnings per share and book value per share. The Graham number is the upper bound of the price range that a defensive investor should pay for the stock. According to the theory, any stock price below the Graham number is considered undervalued, and thus worth investing in

The formula for calculating Graham number is below

Value of share = Graham Number, For NOIDA Graham Number is INR 38 Discounted cash flow method Discounted cash flow (DCF) analysis uses future free cash flow projections and discounts them with a discount rate to arrive at a present value, which is used to evaluate the potential for investment. If the value arrived at through DCF analysis is higher than the current cost of the investment, the opportunity may be a good one This is DCF formula

What is free cash flow for NOIDA ?, below table gives a view in INR million

Using above lets calculate per share DCF value using average FCF value

Few key calls outs FCF growth rate is based on last 4 year's FCF CAGR Terminal growth rate is Zero as toll way will become free for commuters Like last post we get a range of fair values for Noida

Method

Value per share (INR)

Average PE Value Method

27

Economic Value Method

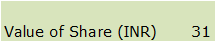

31

Graham Number

38

DCF

36

Hope both the posts helped you to get insights in valuing companies, always try and value companies using multiple methods and get a band of fair values Our third and last post on valuation series would on reverse DCF Till then happy investing