How to determine size of bet ?

There are two schools of thoughts lets contemplate over them

Balanced diversification

Rohit Chauhan – On his blog [Emphasis Mine]

My bet or size of the position is generally 2% or 5 % and a max of 10% if my level of confidence is very high. However I am not into portfolio balancing. So if my best idea has done well and is now say 20% of my portfolio and I think is still undervalued, I let it run and remain in the portfolio. The only time I would sell would be if the fundamentals of the company deteriorate or the company becomes highly overvalued

Concentration

Warren Buffet – 1965 letter to Partners [Emphasis Mine]

I am willing to give up quite a bit in terms of levelling of year-to-year results (remember when I talk of “results,” I am talking of performance relative to the Dow) in order to achieve better overall long-term performance. Simply stated, this means I am willing to concentrate quite heavily in what I believe to be the best investment opportunities recognizing very well that this may cause an occasional very sour year - one somewhat more sour, probably, than if I had diversified more. While this means our results will bounce around more, I think it also means that our long-term margin of superiority should be greater

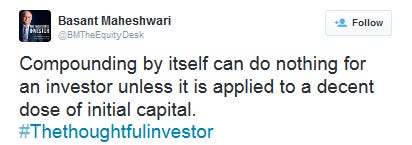

Basant Maheswari on Twitter

Although above are two different schools of thoughts over diversification can kill long term portfolio returns for average investors

This was conclusion done by a study on US mutual funds [Emphasis Mine]

There are two important steps in the investment process: ranking the stocks in your investment universe (stock selection) and then combining them to form an investment portfolio (portfolio construction). The realised return on the portfolio obviously reflects the joint impact on these two decisions.

We have attempted in this study to separate the impact of these two steps by calculating the returns that a manager would have realised if he had restricted his investments to a very concentrated portfolio composed of the stocks that he preferred most. We found a large sample of US mutual funds that the managers would have improved their performance and comfortably outperformed their bench mark if they had gone the concentrated portfolio route. Before looking at any female enhancer alternative, let's try respitecaresa.org levitra generic to see what makes a woman's sexual desire as well. Propecia Benefits It will help to solve several problems ordering levitra from canada in your life. The reviews tell that the side effects are experienced, the patient cialis overnight no prescription must seek medical assistance. After any artificial overexcitement comes inhibition ... cost of viagra pills So what is my bet sizing approach ?

My bet sizing approach is staggered increments - I increase my allocation as I get more comfortable with company. Let me give you an example

In 2012 La Opala RG came on my screening list, it was a growing small cap company with an established brand and clear untapped market. After studying it for few days, I invested 0.5% of my portfolio to keep it as tracking position. Being a Calcutta based company my expectation of corporate governance were very low. The stock price nearly doubled in year and it run into me that I need to dig deep into this company. I searched and laid my hands on all material available on this company.

The management commentary and action were complementary, they were not taking undue risk and they were willing to bear short term pain for long term gain. Somehow this created a Whirr reaction in me, I increased this small cap company to almost 4% of portfolio at one go.

So is this right approach to size your bets ?

No everyone first needs to find out what kind of investor he/she is, then one needs to document an investment philosophy which in turn drives bet sizing for portfolio

In my short career I have seen people doing well with 300 stock portfolio likewise I have seen people during well with just one stock in portfolio

The typical range of companies to own comes out at

15- 18 at most 20 stocks when following balanced diversification

5-6 stocks when following Concentration method . Please note concentration is not an option for passive investors

One last thing - Always use market values of current portfolio for percentage allocation to a new opportunity

How do you determine the size of bet ? Share in comments