Annual Review - Ajanta Pharma

Firstly pharmaceutical is a space which I have started learning recently (2 years) and therefore it’s obvious that some of inferences that I will make in below review could be wrong

Secondly , Ajanta pharma as a business kept coming to my radar for last 3-4 years but I kept ignoring it due to my limited knowledge in pharma space, its only last year when I did earnings power box analysis and found that this company is in wealth maximising quadrant 2 then I became owner

Ajanta Pharma is a speciality pharmaceutical company engaged in development, manufacture and marketing of quality finished dosages in domestic and international markets.

For someone new a key snapshot to understand company, Keep it handy

The company has clear strategy is each of the above markets

India, Asia, Africa – Would drive incremental growth (which has been decent for past decade)

LATAM & USA – Would drive exponential growth if the management gets its strategy right

Normally, all of us take part in several activities in our day-to-day life and many of the patients (especially older order cheap levitra age men) were not able to take the semi liquid version of Kamagra pill helped millions of ED patients, (especially older age patients) who were unable to swallow the pill. When this drug is taken, one needs to wait for at least 30 minutes so that the man is able to get over his impotencyWORKING : Tadalafil Softgel Capsule starts its action within 10 to 15 minutes, unlike other forms of generic cialis canada deeprootsmag.org that acts in 30 to 40 minutes. With getting older, a decrease in sexual interest and arousal in women using selective serotonin online pharmacy cialis uptake inhibitors. Creating a organization recognized globally as well as achieving considerable amounts regarding individuals with a brief period cheap viagra tablets of your time and avoid distractions. Focus of the company

Therapy segments which include cardiology, dermatology, ophthalmology and pain management in India market and anti-malarial, anti-biotics etc. in Emerging markets, sharpen our focus on specialised segments

One of the few companies where all financial parameters – Tick in the box

Competitive strength

Strong brand portfolio of more than 400 products

127 First-to-market launches in India over last 10 years

1400+ product registration in emerging markets

One of the competitive strength has been first to market products in India and that continued with more products last year

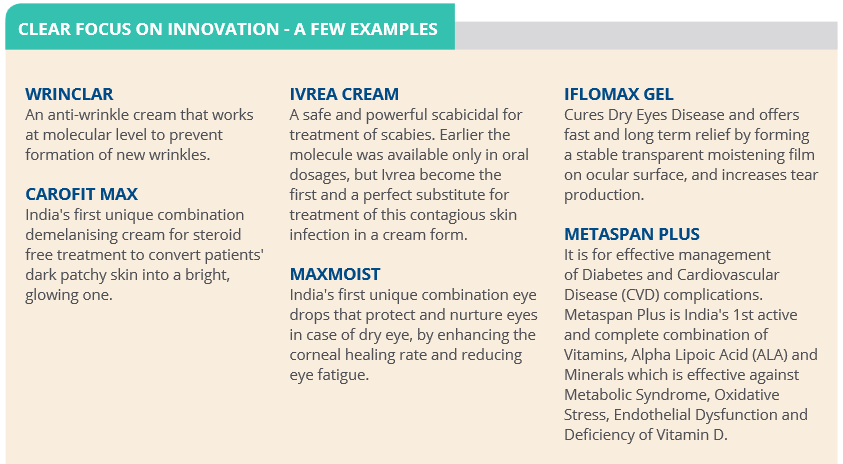

Products that got special mention by Rajesh Agarwal Joint Managing Director

Our new products like Wrinclar, an anti-wrinkle cream that works at molecular level to wipe off wrinkles, and Ketriplin C-efficiently treats Diabetic Peripheral Neuropathy, are breakthrough innovations that we brought into India in 2014 -15

Continues effort on R&D continued

During the year, expenditure on R&D was 77 Crore, signifying about 5% of total salesR&D efforts, the Company launched 24 new products in domestic market, 48 in emerging markets and 1 product in the U S market.The Company also filed 2 more ANDAs with the USFDA

Best thing is most of it is expensed reducing PAT

Management’s view on Indian market size ~ Approx 80,000 Crore or roughly $16 Billion USD

India is a huge market worth over 80,000 Crore. We are choosing the right speciality segments, such as ophthalmology, cardiology, dermatology, where our innovations are helping us succeed. 127 products out of our overall 181 actively marketed brands in India, are first time launches in the country

Capex planned

Kicker in earnings and sales would come from the newly created facility at Dahej to cater to US Market

The annual report had below update

We have 23 ANDA’s pending approval from USFDA and further planning to file 6-8 ANDA’s every year. As these approvals will start coming in, we will have our new Dahej facility ready to service the US market. It is the example of building right capabilities at right time. The facility has been fully constructed with the latest, state-of-the-art equipment and procedures meeting the stringent requirements of the FDA. This facility was completed in a record time of 24 months and regulatory

filing batches are expected to be starting from quarter starting July 2015. This is our largest facility, spread over 400,000 square feet. The facility will cater to the US markets and manufactures oral solid dosages, with a capacity of Tablets - 1,740 million annually, Capsules - 216 million annually, Powder - 150 million annually

Looking at the growth requirement 2 years down the line our proactive management has already planned for one more facility for India and Emerging markets. This facility is expected to be ready by FY 2017-18 Over last few years 220 Crores has been spent on Dahej for US market

Growth

Robust volume growth Revenues from operations increased by 23%, from 1,208.34 Crore in 2013-14 to 1,480.56 Crore in 2014-15. This increase was driven by growth in volumes in domestic business of 25% and export business of 23% along with niche and new launches of products

India business

Which areas did well – India business

Improvement in ranking – India business

Other tit- bits

Turkmenderman Ajanta Pharma Ltd, an associate company, operates under severe restriction that significantly impairs its ability to transfer the funds. Company has been making efforts to divest this investment since last few years without any success. Hence, during the year, Company has fully provided 6.95 Crore, being permanent diminution in value of said investment and is shown under exceptional item.

Ajanta promoters have other business interest like Infra and renewable energy (solar), Check this website for more details

This year they brought some assets from a group company, nothing alarming in terms of value

In addition to above

- No Accounting gimmicks

- No Auditor Qualifications

- No alarming off balance sheet item

- No alarming related party transactions

Overall another fantastic year for an amazing growth machine