How to evaluate a CEO's capital allocation skills

Read below excerpts from Warren Buffet’s share holder letters

Over time, the skill with which a company's managers allocate capital has an enormous impact on the enterprise's value.

The lack of skill that many CEOs have at capital allocation is no small matter: After ten yearson the job, a CEO whose company annually retains earnings equal to 10% of net worth will have been responsible for the deployment of more than 60% of all the capital at work in the business.

Now pause and reflect, how often financial pundits talk about capital allocation skills of a manager when they are evaluating a CEO or MD of a company, not often. In fact a lot of reported results and press releases focus on earnings and sales, while the crucial capital allocation decision and their consequences are missed.

In this post we would learn through an example on how you can assess a management’s capital allocation skill though reported numbers. This post is largely built on a superb paper written by Michael J. Mauboussin in August 2014, download a copy from here

To evaluate capital allocation of any firm’s manager, you need to focus on following things

Sources and Uses of Cash flows

ROIC - The capital allocation Test

Value created with every dollar retained

We will discuss each one of them one at a time

Sources and Uses of Cash flows

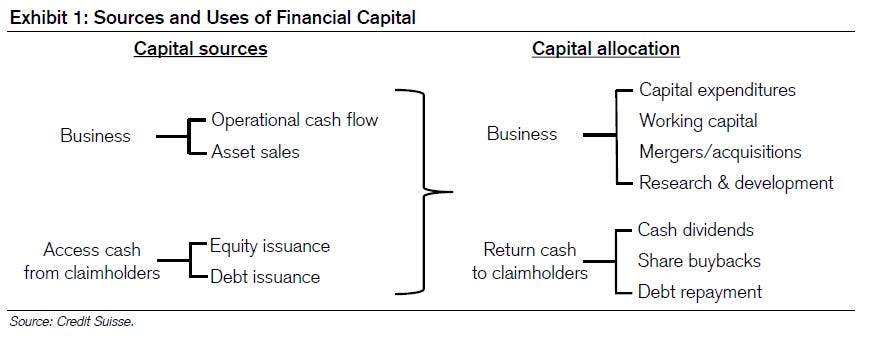

The paper written by Michael J. Mauboussin provides a very succinct snapshot of sources and uses of cash flows, You can see it below

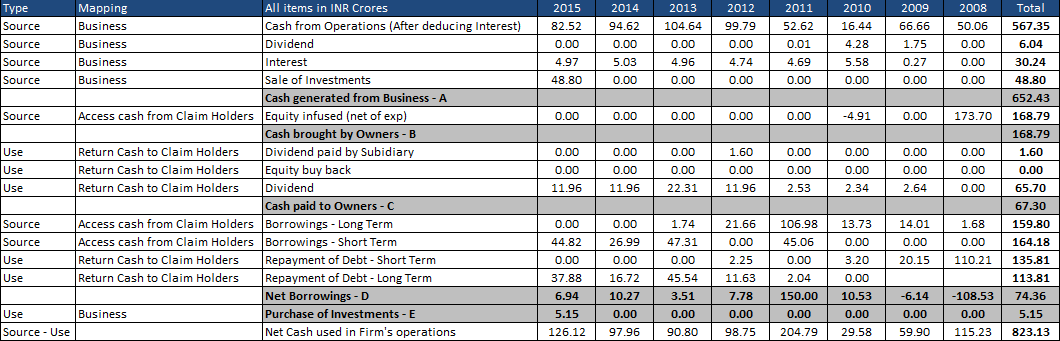

Once you understand sources and uses, you can easily map them to the cash flow statement reported annually, We did a similar exercise for Take Solutions, a global technology solutions and service provider of Life Sciences, Supply Chain Management & Enterprise Solutions. Understanding their sources and uses of cash flows from year 2008-2015

See below snapshot

Most of the money (80%) invested in business was internally financed through CFO

Remember,

There are pros and cons to having internal financing represent a high percentage of investment funding. The pro is that companies are earning high returns on capital in general and need not rely on capital markets to fund their growth. The con is that companies can deploy internally-generated funds into value-destroying investments. The need to raise money from the capital markets creates a check on management’s spending plans.

For Take Solution, since most of money was redeployed in business, Management's capital allocation skills become extremely crucial

Now the discretionary cash can be spent in the following ways

Invest in the business itself if the returns are good – most common approach. Value adding if the business earns more than cost of capital

Acquire other company

Return cash to shareholder via dividends or share buyback

Just hold cash and do nothing

Analysing Take’s cash flow from 2008 to 2015 we find that all of cash generated from business has been redeployed in business. They have done few small acquisitions as well like in 2011 (TAKE Solutions acquired 100 % of UK based WCI Consulting Group)

ROIC - The capital allocation Test

Understanding intrinsic value is as important for managers as it is for investors. When managers are making capital allocation decisions - including decisions to repurchase shares - it's vital that they act in ways that increase per-share intrinsic value and avoid moves that decrease it. - Warren Buffet

However there is no reported metrics to gauge capital allocation in Annual reports, This is where framework provided by above paper comes to our rescue

A useful first step in assessing capital allocation is to see how much was invested in each area for an incremental dollar of sales over time.

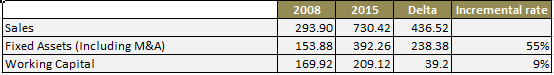

First, we need to understand how many cents company has spent on fixed and working capital for $1 dollar increase in sales ,For Take Solutions between 2008 and 2015, incremental fixed capital rate is 55% and Incremental working capital investment rate is 9% calculated as below

To arrive even at better insights you can calculate above with rolling totals instead of point to point. The above figures corroborate that company has to continually invest in software products to increase its top line.

The second component to assessing capital allocation is determining the output of management’s decisions through an analysis of return on invested capital (ROIC) and return on incremental invested capital (ROIIC).

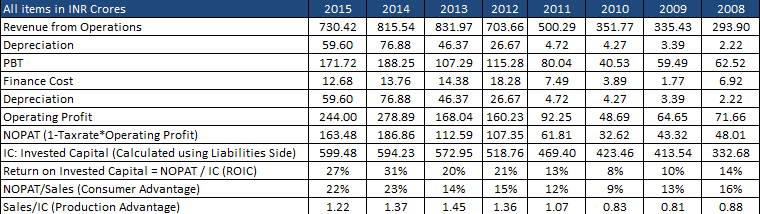

We calculated Take’s ROIC as below

As evident from above in last 3-4 years the ROIC has improved significantly.

Academic research shows that the market rewards investment in organic growth in high return businesses. Typically, companies that earn high ROICs are said to have some sort of competitive advantage. A quick analysis of ROIC indicates whether a company has a competitive advantage and, if so, what lies at the foundation of that advantage.

Bruce Greenwald, a professor at Columbia Business School, argues that there are two sources of competitive advantage: consumer advantage and production advantage.ROIC can provide a quick and useful way to investigate competitive advantage. You can decompose ROIC into two parts, a modified version of what is known as a DuPont Analysis – Both ratios reflect consumer advantage and production advantage

A consumer advantage is the result of the habitual use of a product, high costs of switching to a new product, or high costs of searching for a superior product. A production advantage allows a company to deliver its goods or services more cheaply than its competitors can either as the result of privileged access to inputs or to proprietary technology that is difficult or costly to imitate. A competitive strategy analysis focuses on identifying these sources of advantage and assessing their durability. Breaking Take’s ROIC we understand that high ROIC is driven by consumer advantage, detailed examination should be made to understand why the firm has consumer advantage

Shifting our focus to ROIIC

One potentially useful measure is return on incremental invested capital, or ROIIC. ROIIC properly recognizes that sunk costs are irrelevant and that what matters is the relationship between incremental earnings and incremental investments.

Take’s ROIIC can be calculated as follows

It is preferable to calculate ROIIC on a rolling three- or five-year basis from above we can’t conclude on economic value added by incremental capital

Value created by every dollar retained

Final numerical test you can run is to determine value created by every retained dollar in business

In 1984, Buffett made these comments

“Unrestricted earnings should be retained only where there is a reasonable prospect – backed preferably by historical evidence or, when appropriate by a thoughtful analysis of the future – that for every dollar retained by the corporation, at least one dollar of market value will be created for owners. This will happen only if the capital retained produces incremental earnings equal to, or above, those generally available to investors.”

We put Take solutions to above test on a 5 year rolling basis

The above table shows that management has started deploying retained earnings in effective manner with improving returns for every rupee retained progressively

Summary

Using the above framework, you will be equipped to understand

Sources and uses of cash of the firm – With an insight on whether operations are self-funded or not

Understand Incremental rate of investment required in fixed assets and WC

Evaluate management capital allocation skill using ROIC and ROIIC

Determine what kind of competitive advantage firm has

Finally understand value created by a dollar retained in business

Please share your thoughts below