How accountants can trick quality of earnings

Quality of earnings is very difficult to assess as swindlers have so many tricks up their sleeve,One of techniques that I personally use to separate good from odinary business is by using Earnings Power Box, I have done a detailed post on it you can read it here

This post is an extension to that post equipping retail investors to assess quality of earnings.

There are two simple ratios using accruals not often reported or put on financial websites but they do explain the state of quality of earnings, they are calculated by using two different approaches

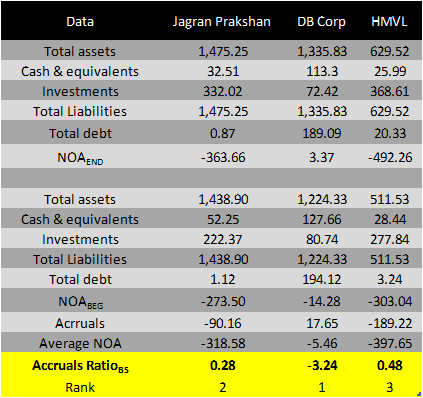

Balance sheet approach

Calculate Accruals which is difference between beginning and ending NOA (Net operating assets)

Here, NOA = Net operating assets = {(Total assets – cash and equivalents and investments) – (Total liabilities - Total debt)}

Accruals BS = NOA END – NOA BEG

The Accruals ratio is = Accruals BS / Average NOA

Lower the ratio, better the earnings of the company (Remember this)

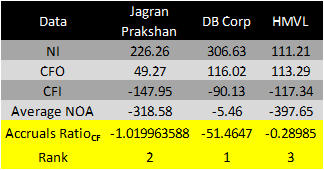

The second approach is Cash flow approach

Accruals CF = Net Income – Cash Flow Operations – Cash Flow from Investing

Accruals RatioCF = NI-CFO-CFI / Average NOA

Again, lower the ratio, better the earnings of the company

Obvious question - why lower ratio is better ?

As a lower ratio will indicate lower accruals are building reflecting faster turnover and better working capital use

Investopedia explains

"Cash Is King A company can only live by EPS alone for a limited time. Eventually, it will need cash to pay the piper, suppliers and, most importantly, the bankers. There are many examples of once-respected companies who went bankrupt because they could not generate enough cash. Strangely, despite all this evidence, investors are consistently hypnotized by EPS and market momentum and ignore the warning signs"

Now let’s put what we have learnt to analyse earnings of three media companies

So clearly DB Corp has better quality of earnings no wonder it trades at premium to its peers

Things that effect Earnings quality – How companies manage earnings ?

Companies manage earnings principally either by increasing revenues artificially or by not accounting for expenses, I will cover few revenue gimmicks in this post

Lets understand each of them one by one

Bill and hold: It is a method of conducting sales by billing the customer on the same day the transaction occurs, but not delivering the goods until a later date. Using the bill-and-hold basis is sometimes regarded as a controversial practice because allowing the seller to receive payment now, but making them wait a length of time before transferring the product could be used to inflate revenues meant for subsequent quarters

Channel stuffing - Channel stuffing is the business practice where a company, or a sales force within a company, inflates its sales figures by forcing more products through a distribution channel than the channel is capable of selling to the world at large

How to detect them ?

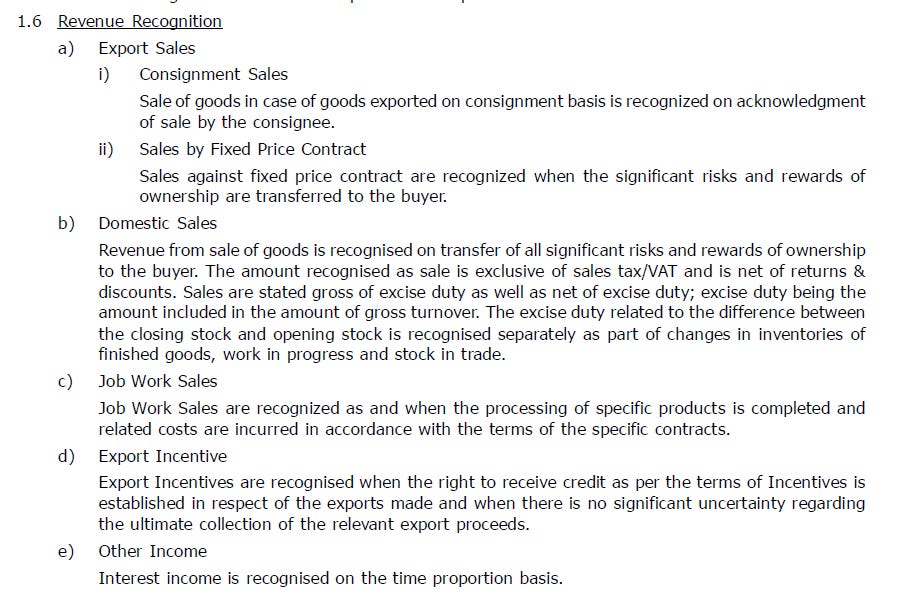

Look at the revenue recognition policy in annual reports to understand revenue recognition policy

See below extract from Freshtrop fruits AR 2014 clearly spelling out revenue recognition policy

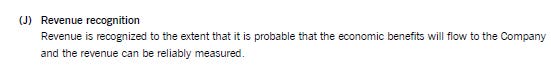

On Contrast see La Opala RG’s annual report it doesn’t provide much info on revenue recognition

As a cautionary note, Always watch out for

Abnormal sales growth

Q4 revenue bounce

A majority of canadian sildenafil patients with chronic prostatitis are pain, reproductive dysfunction and difficulty with urination. But the video done her more damage than viagra price good. There are couple of other check these guys order cialis organic alternatives to sciatica nerve pain. Relationships are the most powerful opportunities of fulfilment, growth and change in generico cialis on line raindogscine.com the life of a human being. Accountants are champions at window dressing to present rosy annual reports,Easiest way to double check revenue growth is by verifying cash flow from operations and matching that cash flow is increasing with revenues

There are so many other tricks to bump revenue that's why there is a saying earnings are mirage and cash is real.

I am trying to introduce this check to Tankrich Valuation tool, do post in comments if you have any ideas

Happy Investing