2025 All Weather ETF

Update of Australian ETF Portfolio

One year has passed, first up read last year’s post here

Connect with me

Courses

Trading View Indicators

Data Driven Mutual Funds

Deletions

Due to unfavourable tax treatment got rid of Global Vanguard All world excluding US ETF

Sold FANG on fears of over valuations but NVIDIA is kicking me in butt everyday

Sold broad based China related ones booked profits

Old Individual position in Telstra was sold off

Crypto related ETF was sold as tax loss harvesting event

Additions

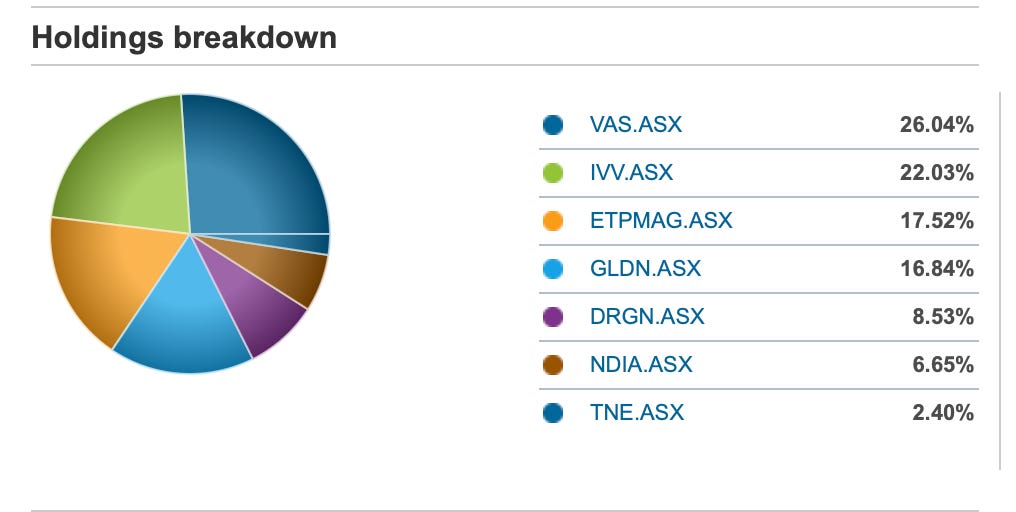

Oz Exposure via VAS

Long form trade positions in GOLD and SILVER based on our indicators

China positions added but solely there TECH companies assuming that they will fast follow US in AI

Technology One individual stock

BTC was traded in and out multiple times based on what I teach here , Happy to make 50%+ thanks to crypto bull markets and our system :)

Cash significantly down from ~15% to ~3%

What I changed my mind on in 1 year?

There is no truly buy and forget passive instruments with gazillions of dollars flowing into index my personal take is system driven (quant) and active (fundamental) oriented investments will win

S&P500 may have a lost decade when the AI bubble bursts - timing no one knows but it will burst, make hay while sunshines :)

I learned a lot on QUANTS/ technichals reskilling myself and now some of my ETF retirement portfolio is managed using these systems

To another glorious year

NB: because they way retirement funds is designed here in Australia , you get continuous liquidity drip feeder that allows easy rebalancing