A small SIP change

Boost your returns

At Tankrich we love tracking markets, we are a data first community, So I ran an experiment. And it changed how I think about SIPs forever.

Let me walk you through it. It started with a simple hypothesis captured below

hunch was - “What if I slightly increased my SIP during bad months say when the market looked cheap?”

How I Defined "Bad Months"

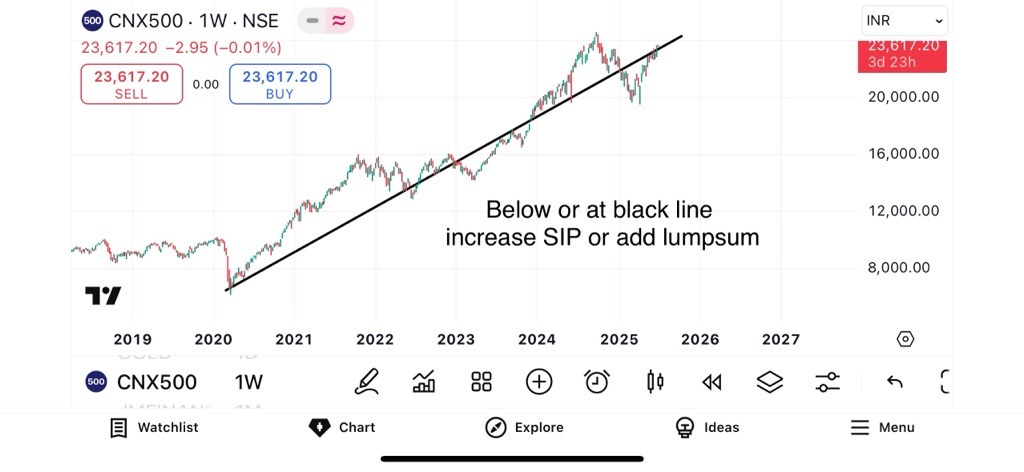

I used the Nifty 500 index as a proxy for the market and plotted a long-term linear trendline going back to 2015.

Then, I did something simple:

If the market was below this trendline, it was cheap.

The further below it fell, the more I invested

The Test

I applied this logic to two mutual funds:

Parag Parikh Flexi Cap Fund

Quant Flexi Cap Fund

Using real NAV data from 2015 to 2025.

I ran two simulations:

A Plain SIP of ₹10,000 per month.

A Dynamic Bump SIP with the adjustments above

Dynamic bumping didn’t feel like a big change. But over 10 years, it added ₹4–5 lakh more to corpus.The XIRR improvement was modest but in investing, small edges compound massively over time.Most importantly: this system didn’t require market timing. Just basic trend awareness.

How You Can Do It Too

Track the Nifty 500’s monthly close vs a trendline or moving average.

When it’s 5–10% below the line, consider adding 20–40% to your SIP that month.

Don’t obsess. Even following this loosely beats doing nothing.

SIPs are great. But smart SIPs are better.

You don’t need to overhaul your portfolio. You just need to listen to the market’s mood and nudge your contributions when it’s feeling down.

It’s one of the strategies that’s:

Backed by data,

Easy to implement, and

Emotionally aligned with long-term investing.

All our MFD clients get a nudge on WhatsApp when we think its time to bump up SIPs using this and several other data driven methods , The real magic isn't in the strategy itself it's in the discipline of systematic investing that both approaches share.