Active Momentum

Flurry of NFOs

All big AMCs are now entering into Active Momentum thematic mutual funds

What are “Active Momentum” funds?

They’re equity funds that try to own stocks where the trend is already up and get out when the trend fades. Unlike the older “momentum index/ETF” products (e.g., Nifty200 Momentum 30), these are actively managed quant funds:

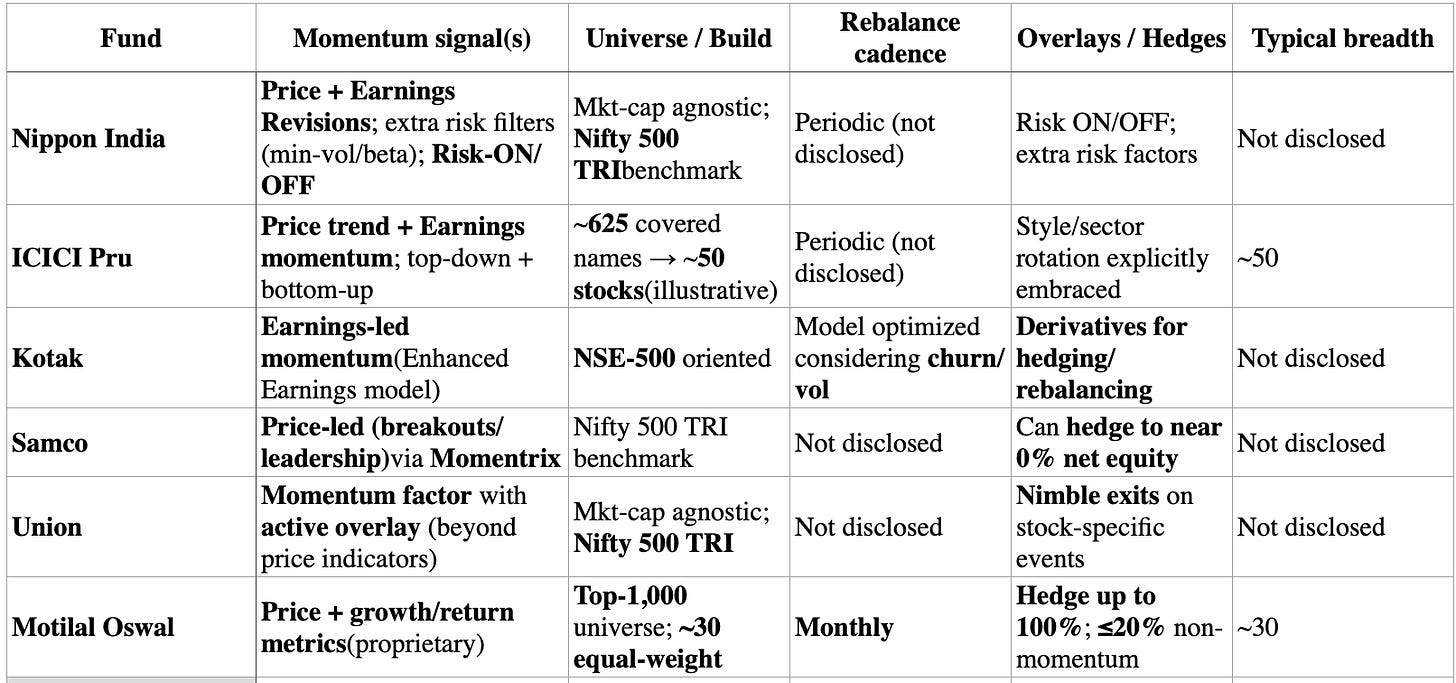

Signals they use:

Price momentum (6–12-month winners keep winning)

Earnings momentum (upward EPS revisions, beats)

Plus filters for liquidity, volatility, risk; some use hedging/risk-on–risk-off overlays.

How they run: rules/algos rank a large universe (often Nifty 500/top-1000), pick the top cohort, rebalance frequently (monthly/quarterly), and rotate as leadership changes.

Why is everyone launching them now?

Momentum’s recent outperformance

The factor has looked great in India the last few years (esp. mid/small caps). AMCs respond to what’s working investor demand is high.Factor investing is mainstream

Investors already know momentum via passive indices/ETFs. “Active momentum” lets AMCs say: we can do better than the simple index broader universe, more signals, risk controls.Product white space

Many houses already have Flexi/Multicap/BAFs. A quant momentum sleeve diversifies their lineup and gathers fresh AUM without launching yet another vanilla fund.Tech + data got good (and cheap)

Easier to run clean pipelines (data checks, execution, slippage control) and defend a systematic edge.Marketing fits the cycle

In a trendy market, “ride the winners, cut the laggards” is an easy pitch simpler to explain than deep-value or quality-only stories.

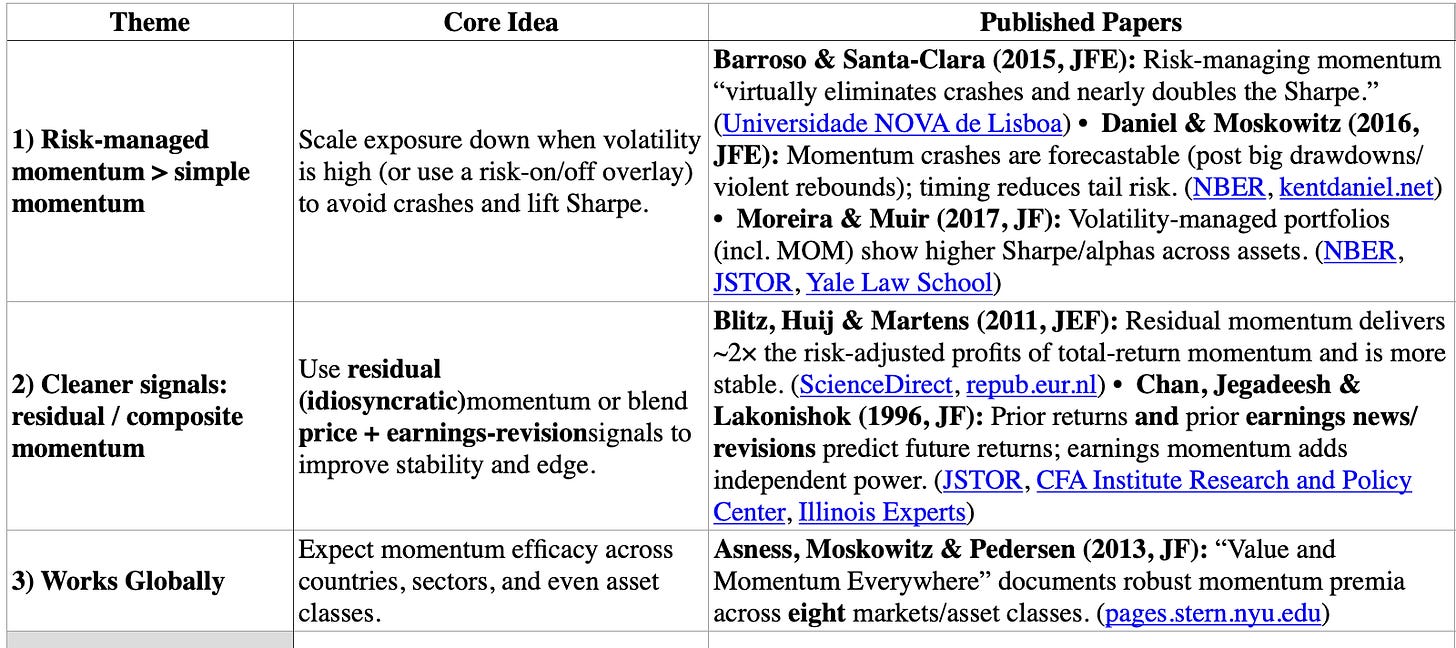

Globally there’s solid, peer-reviewed evidence that “enhanced/active” momentum beats a simple price-only sort, especially on a risk-adjusted basis. The ways it beats are well-studied: (1) risk-manage the momentum sleeve; (2) clean the signal (e.g., residual momentum); and (3) blend price with fundamentals like earnings revisions.

Now lets understand these funds in more details and importantly there key differences