Balance sheet Transition

PTC India

Understanding balance sheet transitions is crucial because it shows how a company’s financial health is changing over time. By tracking shifts in assets, liabilities, and equity, businesses and we can spot growth opportunities, potential risks, and financial stability.

It is one of “success pattern” that repeats multiple times and something that should be in your repertoire.

In this post we will look at one example from past and 1 current evolving story where it may play out.

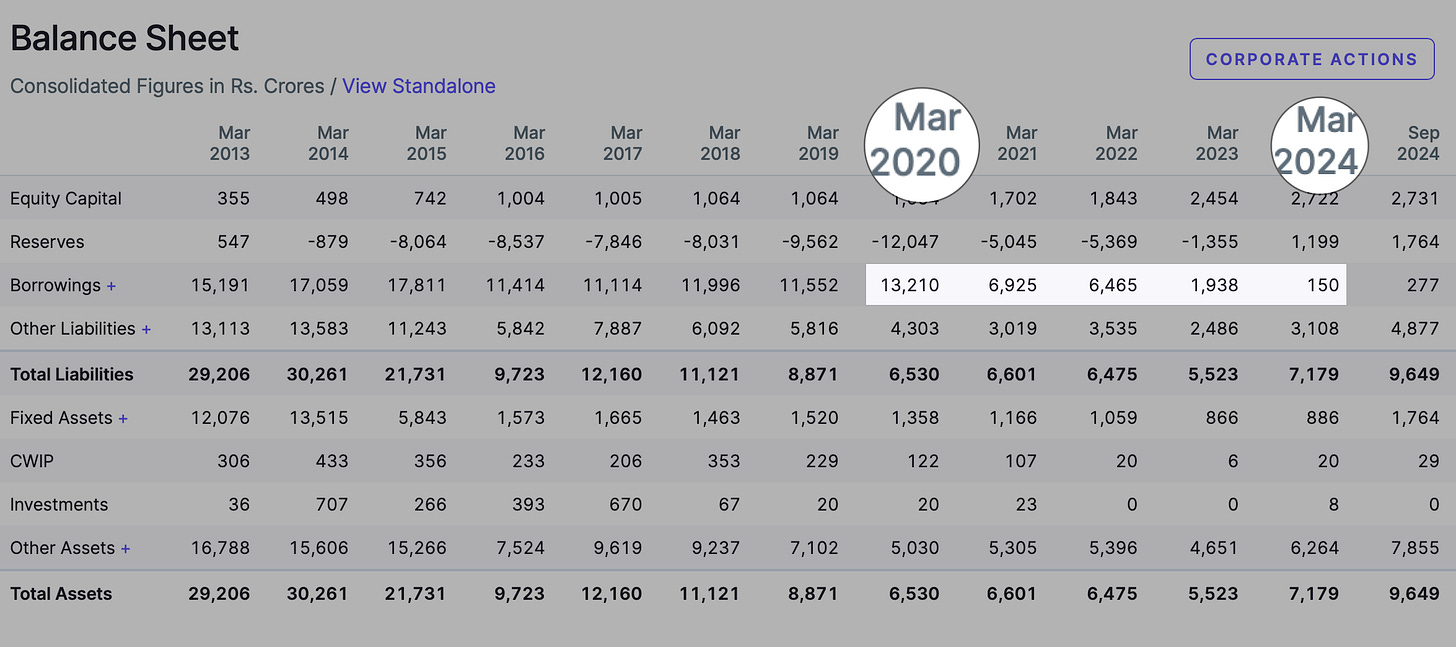

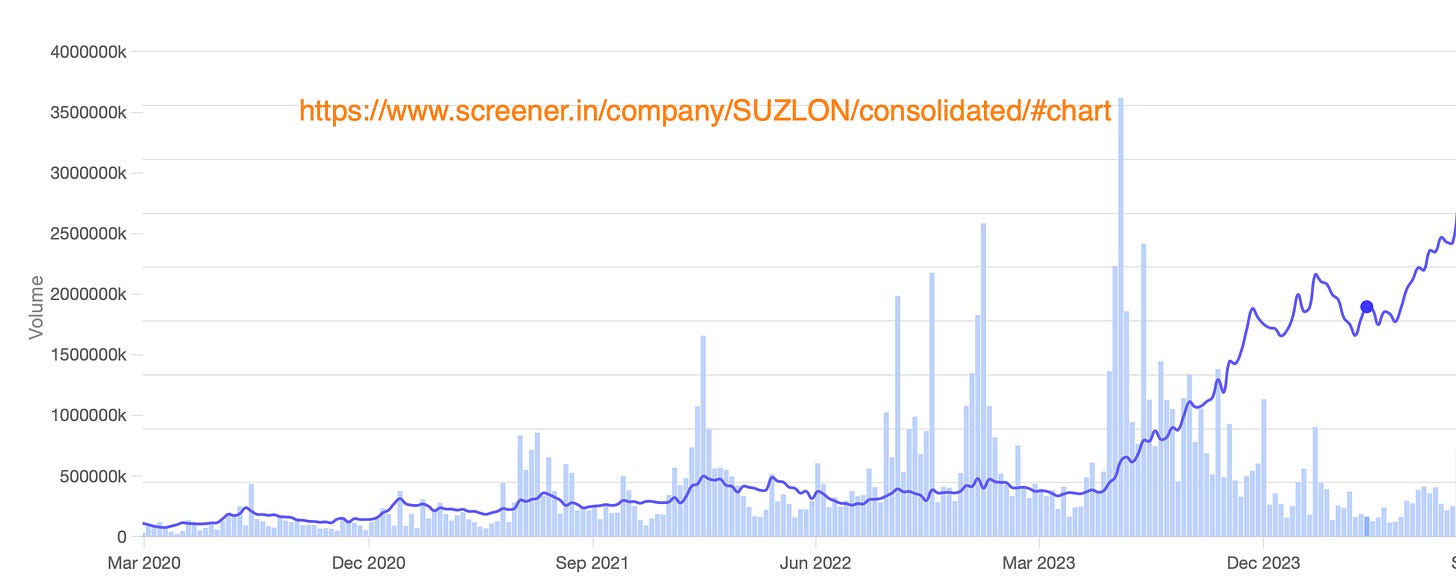

Pause for a minute and look at below screen grab from screener.in for Suzlon energy

the borrowing were restructured and reduced from Rs 13,210 crore to Rs 150 crore a complete makeover

The shareholders were rewarded with 20x returns

Now onto what’s happening at PTC India, for year ended 31st March 2024, their balance sheet had Rs 654 crore which was noted as asset held for sale