Easy way to beat dollar cost average

Family & friends extensively use dollar cost averaging to invest in equity markets , in mutual fund industry in India its also called as SIP or Systematic Investment plan. It has proven to be a very successful method to build wealth in equity markets.

I am proposing in this post a method that would super charge your wealth creation journey, Its called DCA+

How to practice DCA+?

Two simple steps

Don’t change your SIPs or DCAs continue them

When you identify DCA+ investment zone on a chart, investment a lumpsum (if available) into markets

Now what are DCA+ indicators, 2 simple ones identify when

Markets are down 10-25% from its most recent peak or

Markets are trading below its long term (10 year) trend line

I have created a simple diagram to show them

In above diagram

red dots are points where markets have fallen between 10-25% off its recent high

green shaded area indicates market trading below trend line

Investments during these times super charge your SIP results.

It’s easy to do this exercise with plethora free tools and alerts available today. lets look at a real example step by step

go to trading view

Launch nifty 50 chart monthly chart for last 10 years

take bottom from in this example from 2016 and draw a trendline (45 degree)

Check if market is below this blue tend line if yes? good to do lumpsum in your nifty 50 , if no then just continue with your regular SIP

The red circles are months when DCA+ will super charge wealth creation

Finding when market is below 10-25% high is even more easier these days with technology ,set them up in brokerage apps or chat trading software

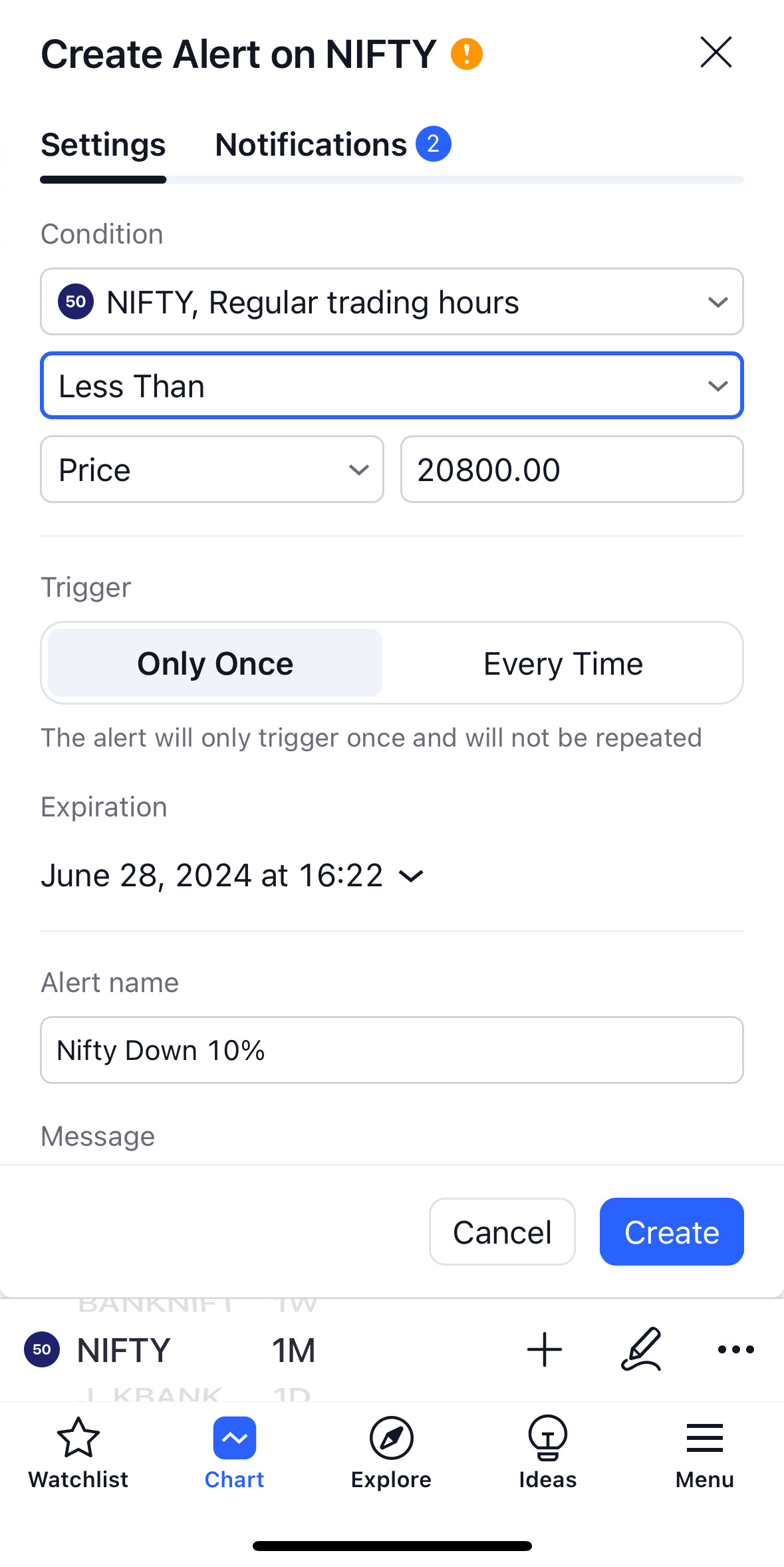

Here is simple alert I created on Trading view for Nifty 50, I looked up recent 52week High and multiple it by 0.9 to get levels were DCA+ is applicable in our example it would be 20800

Just set an alert to email you if market goes below 20800 and you are set

to get an alert from the app (trading view)

you can use this method for any Index, Mutual Funds, market cap weighted broad ETFs but not individual stocks

Please don’t use this for individual stocks its not useful

Happy Investing