Finding Stocks with Earnings Power for Long-Term Profits

One size doesn't fit all is often said for investments. However Hewitt Heiserman has written a remarkable book that gives you a blueprint for finding great growth stocks for the next decade without taking on a lot of risk in the process. His method can be applied to all types of companies.

According to the book there are three key factors which drive long term profits for a successful investment

a. Competitive advantages enjoyed by the firm or what Warren Buffet calls Moats that keep rivals at bay. The book doesn't provide any tool to determine competitive advantage however it provides a quick check-list to ascertain if a firm is enjoying competitive advantage. You can read our recently posted article on understanding competitive advantage to gain more insights

b. Valuations – Great companies can become lousy investments if brought at wrong price, the book again has little on valuation front. Use our stock price calculator to get first-hand view of value of stock

c. Earnings power - Whether a company possesses authentic earnings power for long-term growth, The 2 earnings power ratios you need to calculate before making your next investment. The Enterprising EPS and Defensive EPS.

The first is the enterprising income statement that allows you to determine if a company can create value for its investors. The second is the defensive income statement that allows you to determine if a company can self-fund i.e. does it need to borrow money or can it grow from within. However it is the the author's trademarked Earnings Power Chart that combines these two statements giving a pictorial view of earnings of the firm. Hewitt Heiserman effortlessly incorporates Benjamin Graham's defensive and enterprising perspectives into one easy-to-use system to determine a company's true earnings power.

The ‘defensive income statement’ proposed by Hewitt calculates Free Cash Flow, and the ‘enterprising income statement’ calculates Economic Profit. There is an excellent post explaining you step by step on how to prepare these statements

All said and done, It was time for me to roll up my sleeves and start putting my learnings from this book to practice and after preparing Earnings Power Chart of several companies, I am convinced this is one of most powerful tools a small investor can use to make informed decisions.

Before I start taking you through some of companies that I analysed let me briefly explain the four quadrants in the earnings power chart

Investors would be better off investing in companies in quadrant 2. You will also see the that stock price largely follows the position of the company in quadrant. The best companies to buy are the one which are in quadrant 2 rising like staircase. The method to draw Earnings Power Chart is by plotting defensive EPS of the company on vertical axis and enterprising EPS of the company on vertical axis.

To be consistent all figures were taken from individual balance sheets of the companies and share price is as on May 1 for that particular year

Let’s look at some of the companies I ran through, First up is NOIDA TOLL BRIDGE

The earnings power chart show that it is a defensive company, The chart indicates that there would not be significant rise in price of such companies . A quick check on price would concur that

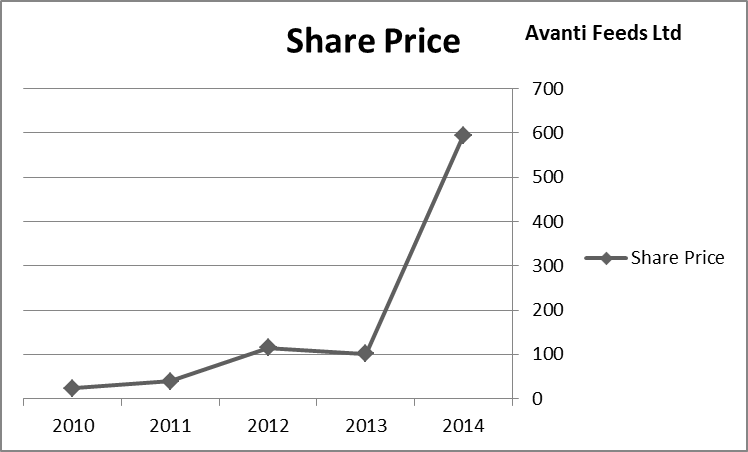

Next I took up a cyclical company AVANTI FEEDS LTD, let’s look at earnings quality of the company

The fortunes have been swinging year on year as expected, however company has earned at least defensive profits almost all years and has stock market rewarded whenever company's earnings have moved in quadrant 2 in year 2011 to 12 and then again in 2013 to 2014

The companies in quadrant 2 with stair case earnings create maximum wealth for investors, we examine one such company PAGE INDUSTRIES LTD

The share price rewarded investors heavily growing 7 times in 4 years in a bear market. If the company continues its ascend in top right quadrant 2 the stock price would follow.

The key question is when to start investing in these massive wealth gainers, the author says the best time is initial years when ascendency is seen quadrant 2.

The Earnings Power Chart can’t be used for banking and financial companies however it is a great tool to run on your existing portfolio.

Now it’s your turn create Earnings Power box by creating defensive and enterprising income statements.

Lastly grab the book, it is bound to make you smarter investor.