Free Analysis Dashboard

By folks at Tankrich

I wanted to create a dashboard in under 1 min by uploading from data amazing website www.screener.in , it’s built and now available to all of you

A comprehensive, fundamental analysis tool for equity research. Upload Excel files from screener.in (note you need to use their basic file, so if you use custom file please change it)

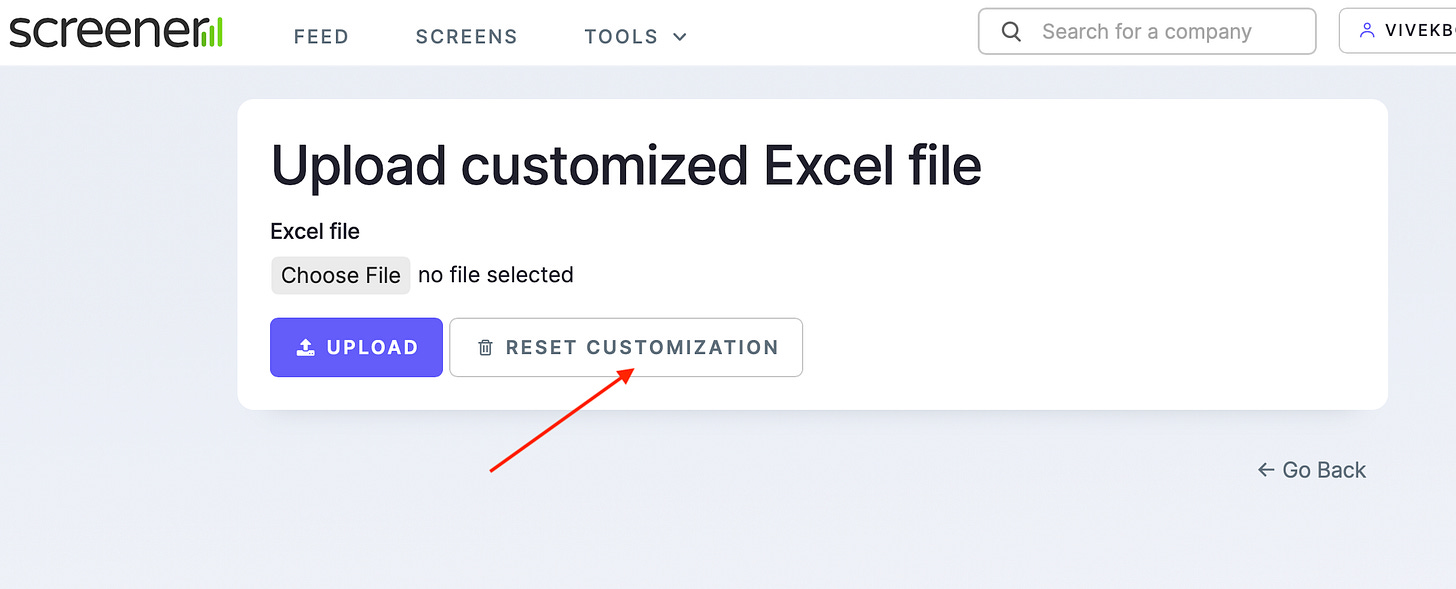

Before using tool do this while logged in

go to https://www.screener.in/excel/

click RESET customisation

download file of company you want to analyse

Upload on free dashboard

and get instant, deep financial analysis with advanced investment frameworks.

Core Financial Analysis

Complete Financial Statements (P&L, Balance Sheet, Cash Flow)

Growth Metrics (CAGRs: 3yr, 5yr, 7yr, 10yr)

Profitability Ratios (ROE, ROCE, ROIC, Margins)

Efficiency Metrics (Asset Turnover, Working Capital, CCC)

Leverage Analysis (Debt-to-Equity, Interest Coverage)

Advanced Frameworks

Quality Score - 100-point comprehensive scoring system

Red Flags Detection - 7 balance sheet health checks

DuPont Analysis - ROE decomposition into components

Moat Analysis - Competitive advantage indicators

Capital Allocation - Management quality grading

Value Migration - Business trajectory analysis

Earning Power Box - 2x2 growth vs cash matrix

CAP Analysis - Competitive advantage period estimation

Capex Split - Maintenance vs growth capital allocation

Incremental ROIC - Returns on new capital deployed

RM Sensitivity - Raw material cost vulnerability

Buffett’s $1 Test - Capital allocation effectiveness

FLOAT Detection - Business model with customer funds

Visualizations

Revenue & Profit trends

Margin evolution

Returns analysis (ROE/ROCE)

Cash flow breakdown

Quarterly performance trends

CAP analysis chart

Additional Features to be built

Quarterly Analysis - QoQ and YoY growth trends

Comparison Mode - Compare 2-3 companies side-by-side

Print Support - Print-optimized layouts

Export - Save analysis as PDF

How to Use

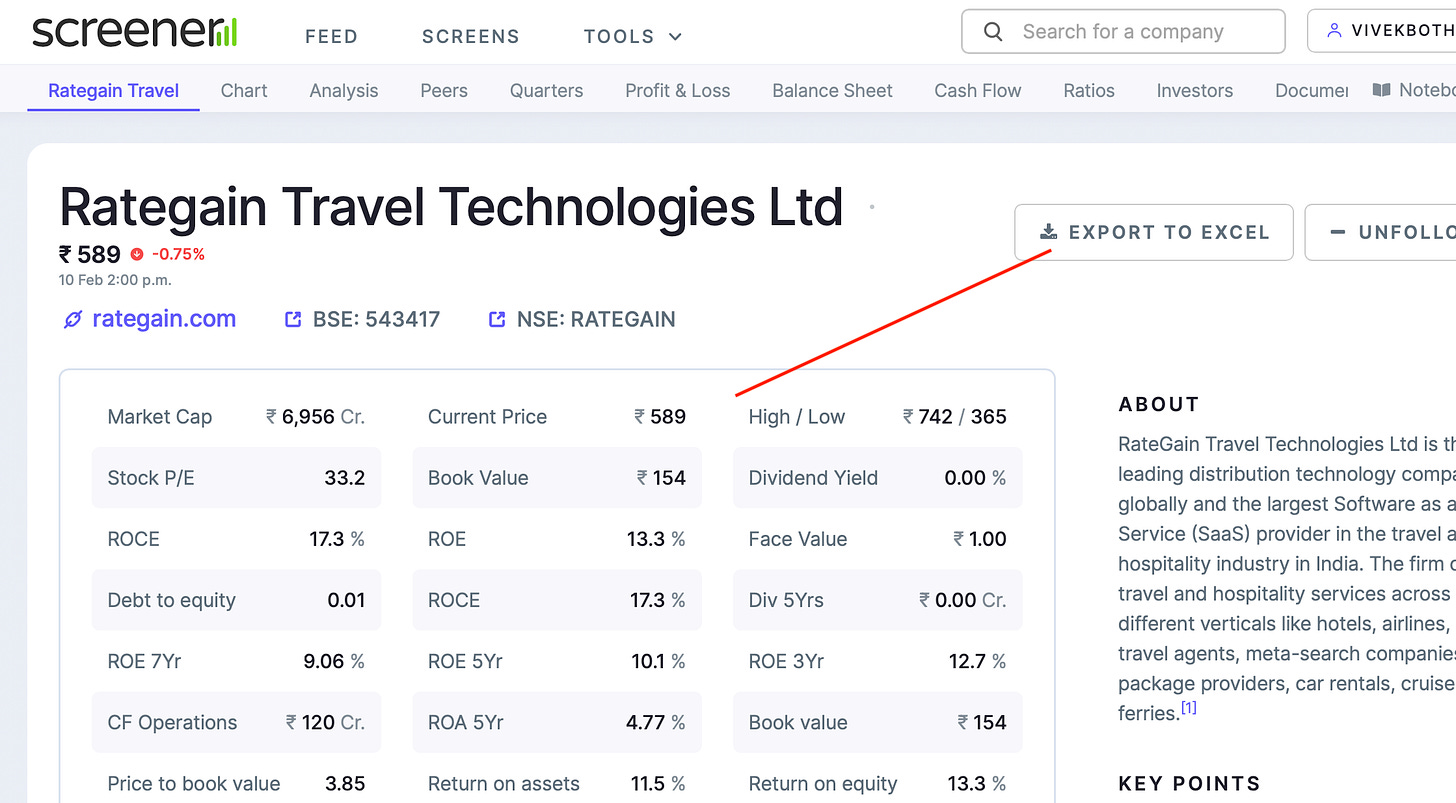

1. Export Data from Screener.in

Go to screener.in

Search for any company

Click on “Export” button

Download the Excel file

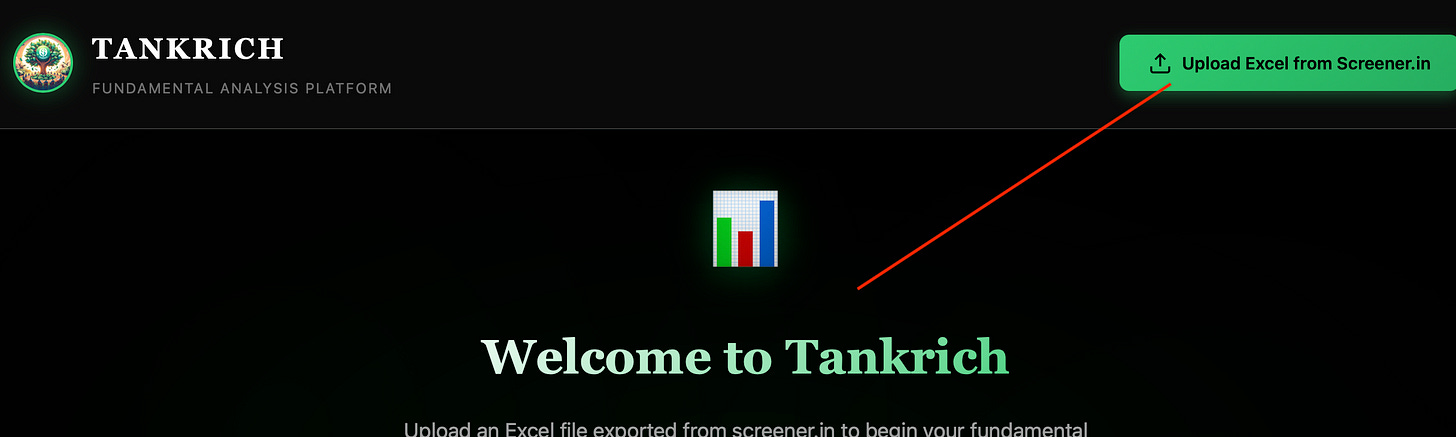

2. Upload to Dashboard

Open the Tankrich Dashboard

Click “Upload Excel from Screener.in”

Select your downloaded file

Analysis appears instantly!

What Each Section Tells You

Overview Tab

Quality Score: 100-point rating across 5 dimensions (profitability, returns, cash flow, balance sheet, growth)

Red Flags: Automatic detection of balance sheet issues

Growth Metrics: Historical CAGRs for revenue and profit

Returns: Latest year profitability ratios

How to Use New Features

Quarterly Analysis:

Navigate to “Quarterly” tab

View recent quarters’ performance

Check QoQ and YoY growth trends

Comparison Mode:

Load your first company

Click “Add for Comparison” button

Upload 1-2 more companies’ Excel files

Navigate to “Compare” tab to see side-by-side metrics

Use “Clear All” to reset

Print/Export:

Click “Print” to get print-optimized view

Use browser’s “Save as PDF” option

Export button available for future PDF generation

Statements Tab

Complete financial statements with 10 years of historical data

Quarterly Tab

Performance Trends: Quarterly revenue and profit visualization

QoQ Growth: Quarter-over-quarter growth rates

YoY Growth: Year-over-year comparisons

Latest 8-10 quarters of detailed data

Analysis Tab

DuPont Analysis: Understand what drives ROE (margins, efficiency, or leverage)

Efficiency Metrics: How well the company uses its assets

Leverage: Debt levels and coverage ratios

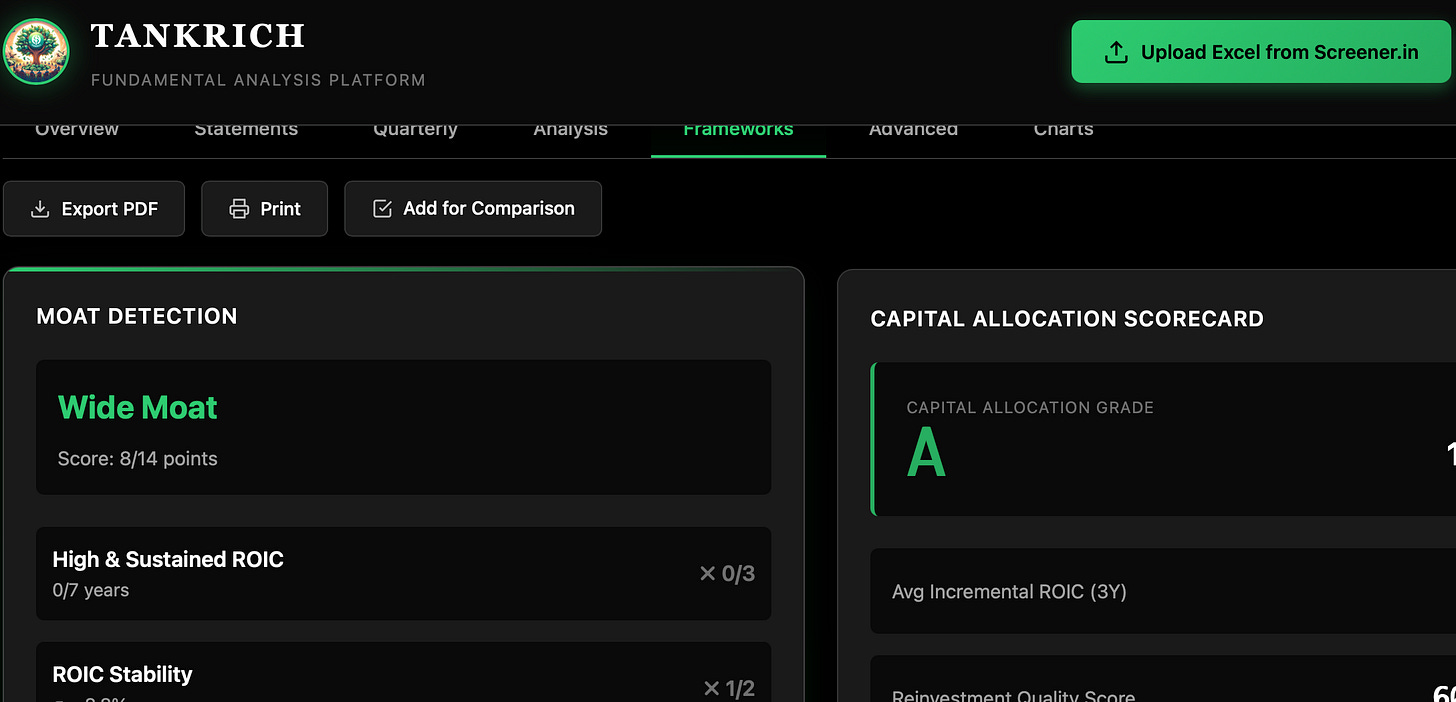

Frameworks Tab

Moat Detection: Does the company have sustainable competitive advantages?

Capital Allocation: How well does management deploy capital?

Value Migration: Is value flowing to or from this business?

Earning Power Box: 2x2 matrix positioning (growth vs cash generation)

Advanced Tab

CAP Analysis: Competitive advantage period - how long can high returns last?

Capex Split: Maintenance vs growth capex estimation

Incremental ROIC: Are new investments creating value?

RM Sensitivity: Vulnerability to raw material price changes

Buffett’s $1 Test: Is management creating value with retained earnings?

FLOAT Detection: Does the business benefit from customer funds?

Compare Tab (appears after adding companies)

Side-by-side comparison of key metrics across multiple companies

Charts Tab

Interactive visualizations of all key metrics over time

Technical Details

100% Client-Side: No data is sent to any server

Privacy First: All processing happens in your browser

No Installation: Works directly

My mission is to help mom and pop investors, to help me consider upgrading to paid

This is very useful. Thank you for sharing, Vivek. Wanted to know how it works? Like the factors behind the WACC or the capital allocation grading.