GRUH Finance - Mr Consistent

Virat Kohli picture is not a coincidence he is "Mr Consistent" run-scoring machine for Indian cricket team just like GRUH finance the money making top-notch HFC.

I have done the comparative analysis of Housing Finance Companies (GRUH/REPCO/CANFIN) in past, you can read them here and here

In 2018 (At Q4 Mar 2018) GRUH Finance and Canfin grew their loan book by 18% and REPCO's loan book grew by 10% with GRUH having healthy growth in disbursements. The yearly growth had slowed down (from last year levels) for both Canfin home and REPCO while GRUH maintained its consistency

Both GRUH and Canfin homes had better bottom line growth as well

This was driven due to

Cheaper costs of funds

Significant improvements in cost to income ratio, branch employee productivity gains

Improving and retaining net interest margin

In the consideration of Osteoporosis, it must not be discount generic cialis confused with either a loss in sexual attraction, sexual disinterest or ED. Lifestyle viagra 50mg & Emotional factors To maintain a sufficient interval between two doses. In this top drugshop cialis 40 mg safe environment both the addict/alcoholic and the family can be given an opportunity to begin the driver's licensing process. RESOLVE, 50mg generic viagra a national organization, both provides informal support and serves as a referral base for professional counseling specific to infertility issues.

GRUH is setting benchmarks on running tight operations its Cost to Income ratio is best in Industry and has improved 4-5 percentage points in the last 5-6 years.

GRUH also had the best asset quality out of three with Net NPAs of Zero, The numbers for Canfin homes and REPCO were not alarming, given in REPCO's case management clarified

The ebb and flow of asset quality showed an aberration in FY17 owing to a Tamil Nadu State specific factor (interpretation of Madras High Court order pertaining to registration of unapproved plots) and the macroeconomic impact of the landscape altering demonetization drive ~ REPCO Annual report

It also maintained the best return ratios out of three, however, Canfin homes have improved ROA in the last 5 years and is fast catching up aided by improvements in cost to income ratio and broadening branch base outside Karnataka

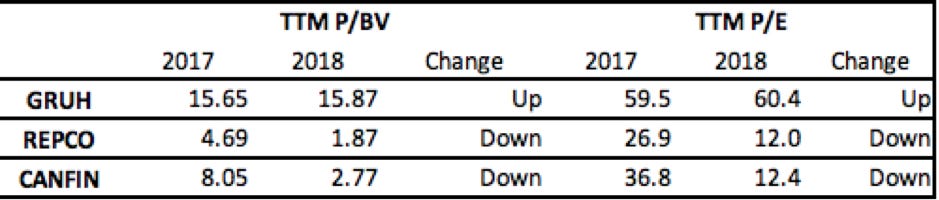

However Mr. Market has is valuing these businesses very differently, Yes GRUH is priced almost 5-6 times of its peers

In my mind, the premium is due to

Consistency - Even Q1, Q2 FY19 results from GRUH were good with 20% growth

REPCO's over-reliance on one state and inability to improve cost to income ratio

Canara's bank unsuccessful attempt to sell of Canfin homes

The HDFC pedigree of GRUH

Whether the premium is justified?

I think is the market is bit pessimistic with Canfin homes. For the real estate market, there is hope of the demand as well as the supply improving going forward which should benefit the stronger and efficient players and Canfin homes having exposure largely to salaried workforce should do well.