How I am Invested?

in 2025

I often get asked how I personally invest. In this post, I’ll share a breakdown of my “investment boxes” and the latest allocation as per my last reconciliation.

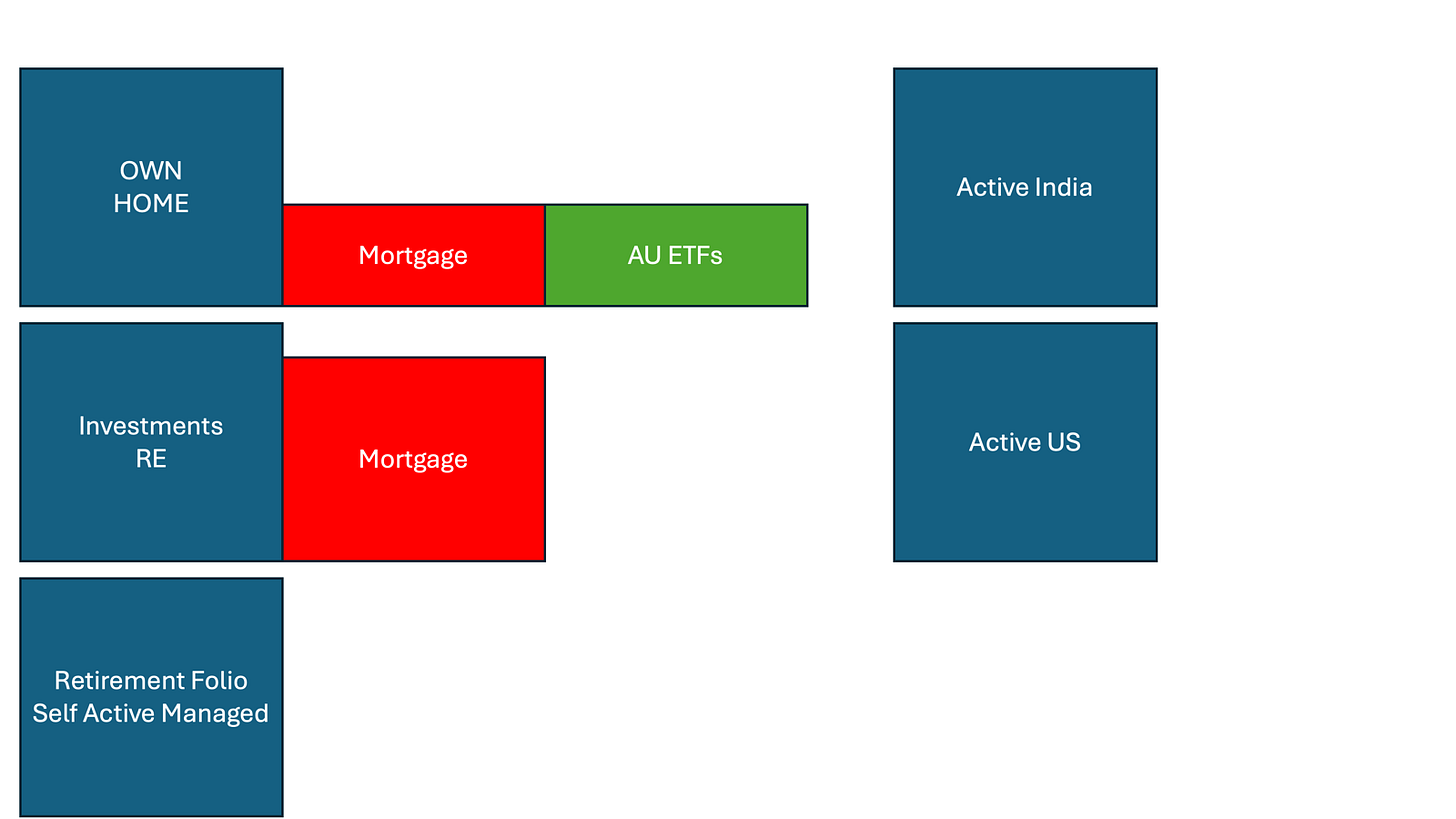

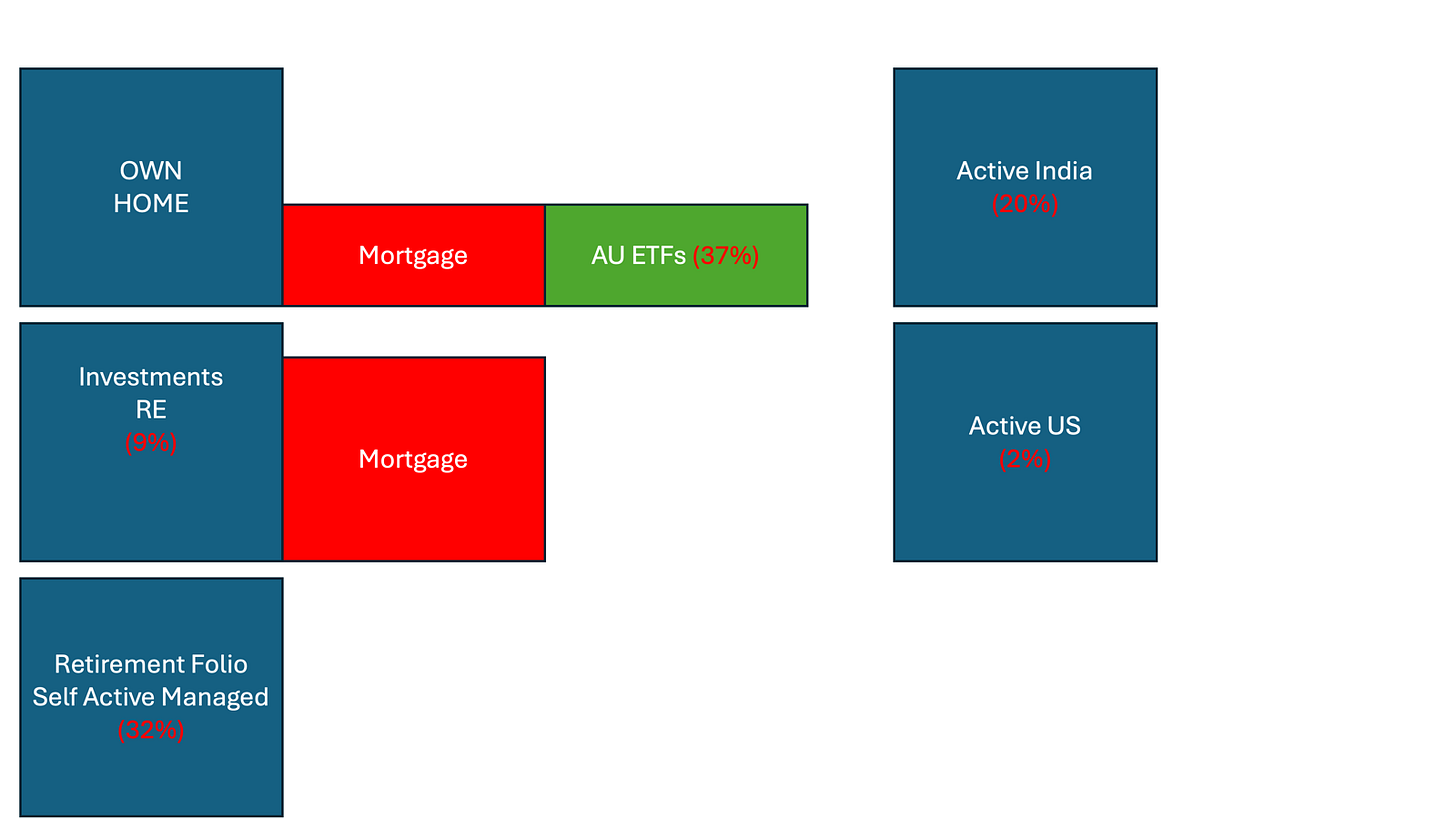

Below is good representation of my investment boxes

Box 1: Own Home + Mortgage Offset with ETFs

My home loan isn’t fully paid off on paper, but my approach has been to build a portfolio of passive Australian ETFs roughly equal to the mortgage balance.

Having a mortgage keeps me hustling, but it’s comforting to know I could clear it tomorrow if I chose to.

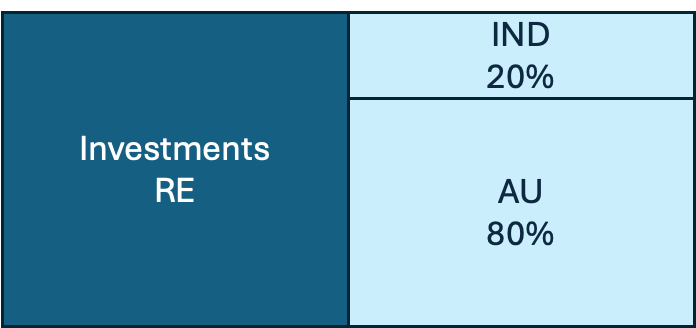

Box 2: Real Estate

I was a late starter here. The goal is to put in as little equity as possible while still controlling large assets that tenants gradually pay off over 20–25 years.

In hindsight, my India real estate allocation was a mistake yields are below 3%, refinancing is messy, and management is difficult. I’ll likely reduce this exposure further.

Education only. Not investment, tax, accounting, or legal advice. Nothing here is a recommendation or solicitation to buy/sell any security or crypto asset. Markets involve risk, including loss of principal. Past performance is not indicative of future results. Do your own research and consult a qualified professional. By reading, you accept the full disclaimer that you alone are responsible for your investment decisions.

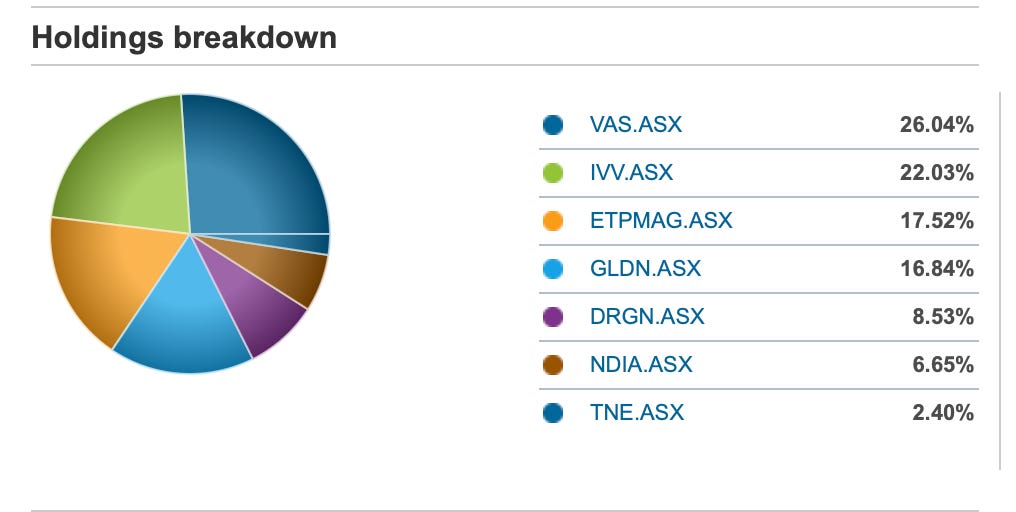

Box 3: Retirement Portfolio (Self-Managed)

This is a government-mandated retirement fund that I took over in 2019. It can’t be redeemed until age 65, though I can rotate within it.

I manage it thematically, mostly with ETFs, and the allocations change frequently. I shared a full breakdown in an earlier post.

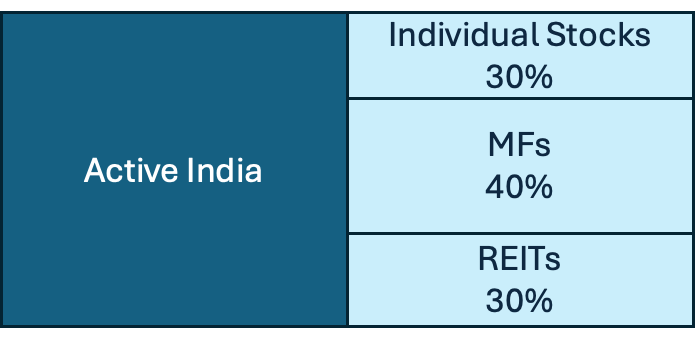

Box 4: Active India

This is where my active journey began. Post-Covid, I saw the power of mutual funds and have steadily increased allocation here.

Because Boxes 3 and 5 demand attention, I actively manage Box 4 less. My mix is:

Mutual Funds: ~40%

Individual Stocks: ~30%

REITs: ~30%

Few individual stocks I am invested in India it may change tomorrow so definitely not a recommendation some I hold for 2 weeks and some 2 years and some 20 years

SWIGGY

Aditya Vision

there are others but tiny tracking positions

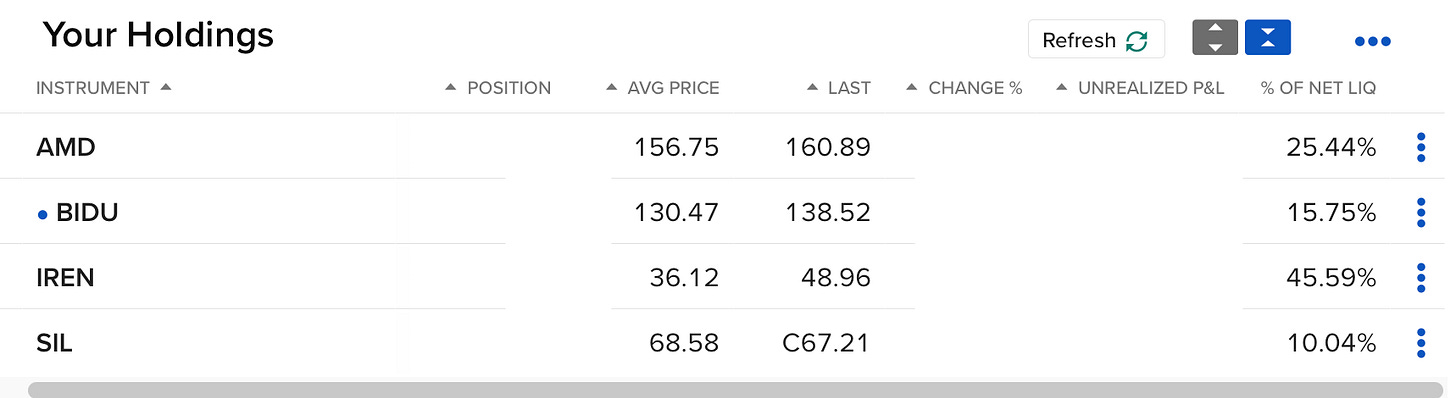

Box 5: Active US

After five years in US ETFs, 2024–25 is when I started taking individual positions in US markets.

Here I use everything momentum, fundamentals, technical charts whatever feels appropriate at the time. Again, none of this is advice, just my own evolving experiment, again may change tomorrow so definitely not a recommendation

Like to follow my Active US portfolio? I post a snapshot every week here

Now big the question

how much of my cash is in each box?

Mortgage Offset ETFs → 35-37%

Real Estate Investments → 7-9%

Retirement Portfolio (Self-Managed) → 32%

Active India → 18-20%

Active US → <1%

This structure means that even a “50-bagger” in my US portfolio won’t move the overall needle too much but that’s by design. I don’t want a single big bet to sink the entire portfolio.

Over the last 10–12 years, my main focus was building Australian ETF exposure to match my mortgage. Going forward, I expect that stream to slow down, and the other boxes to gradually take up more share.

if you like this breakdown give it like or comment and I will publish periodic updates to this!

Final Note

This breakdown is for education only not investment, tax, or legal advice. Please do your own research and consult professionals before making financial decisions.

Courses

Trading View Indicators

Data Driven Mutual Funds

Clear strategic thinking and well diversified asset allocation 👏