Leveraging in right products

Zerodha recently introduced Margin Trading Facility (MTF), you can read about it here

This got me thinking, Can we use this product to build wealth?

There is a similar product in Australia with good reviews

Why

remember what Archimedes said

"Give me a lever long enough and a fulcrum on which to place it, and I shall move the world."

Leverage when used judiciously can have wonderful outcome and can equally be disastrous if used incorrectly.

Where would be best place to put this product to good use? Given its steep cost 0.04% interest rate per day probably nowhere?

Using basic excel calculations tells me that if the leveraged instrument is able to grow between 9-10% long term ,I have taken 10 years in example below, then the leveraged returns would make sense and outperform no MTF scenario

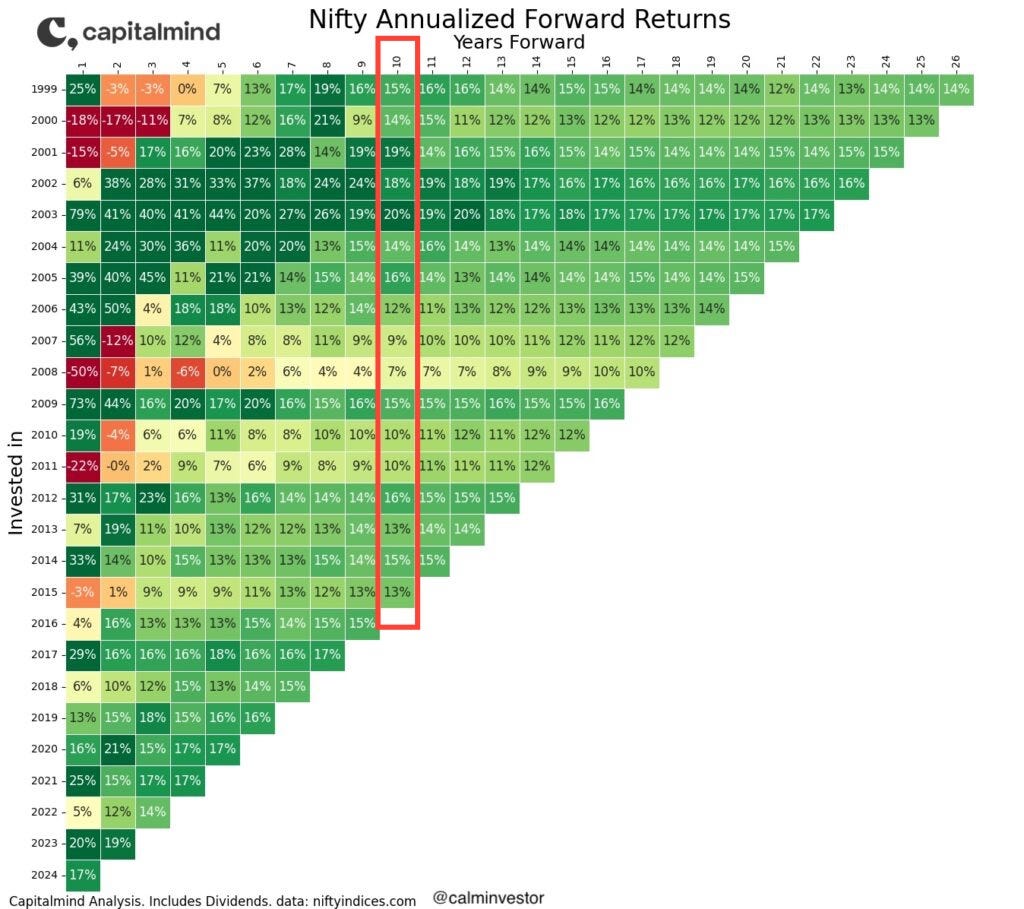

Will Nifty 50 give me 9-10% CAGR in 10 years? Likely but not guaranteed. The good guys at Capital Mind gave us below

if you spend time on 10 year future returns column , the red rectangle in above image, you will notice that Nifty has comfortably got more than 10% CAGR except when the starting year was 2007 or 2008 in the GFC (Great Financial Crisis)

Also MTF has some expected margin complications like below

The MTF position of the Client shall be marked to market on a daily basis. Accordingly, at any point of time, if the MTM loss of the Client goes beyond the permissible position value of any particular script, the Client position for such script would be squared off at the prevailing market rate by invoking the shares associated to such position of the Client. Statutory & transaction charges applicable for confiscating the shares would be borne by the Client.

Would you use this product for long term wealth creation?

I would not unless we are in deep bear market, we are due for one

Get something to read or think daily on WhatsApp Join 140+ smart people here

reply in comments