Neuland labs - 5 bagger in 4 years

Neuland labs is a 30+year-old Hyderabad-based Pharmaceutical company engaged in R&D, manufacturing and marketing of a wide range of bulk drugs, intermediates and custom synthesis of APIs

I have written on Neuland labs in 2020 here is link and 2021 here is link

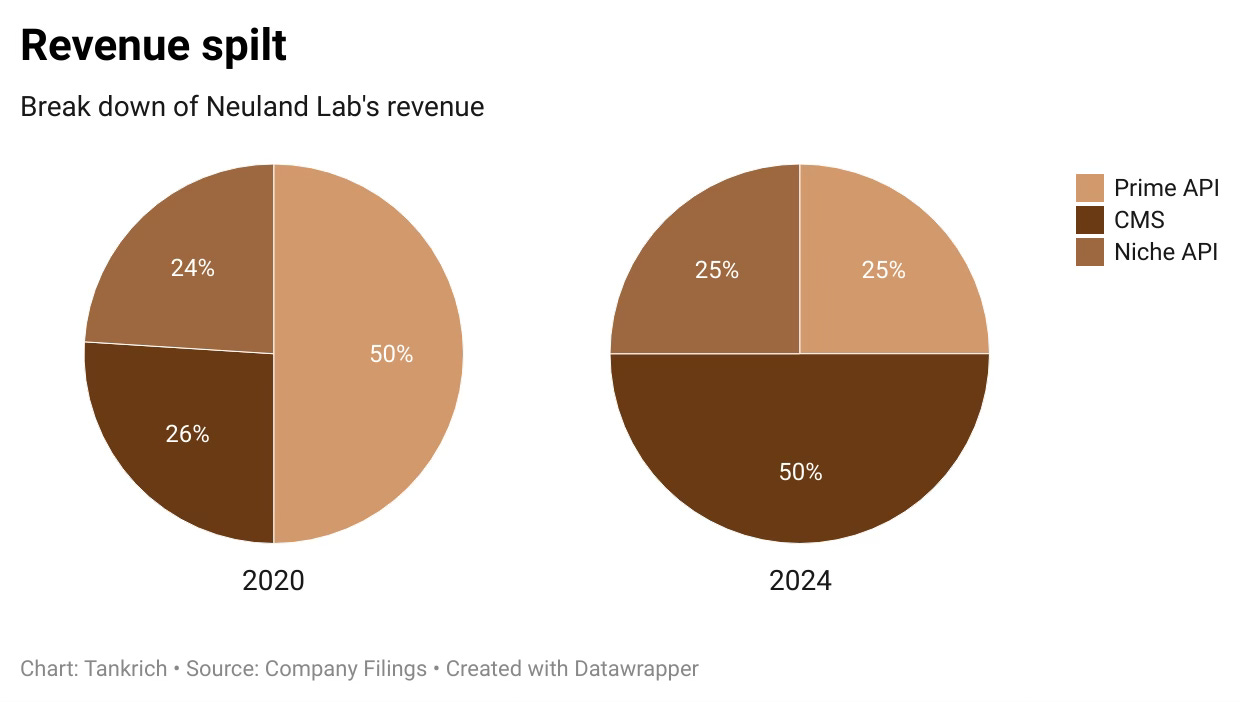

In above posts I argued why Neuland is one of most interesting small cap plays in CDMO business . The value migration to higher margin CMS division has played out , look at the below break down of revenue

The impact of value migration is seen across financial metrics

ROCE - 4x from 2020

PAT margins - 10x

Reduction in debt has helped business as well as net debt to equity has reduced by 66%

This has created tremendous wealth for shareholders , the market cap has increased from INR 1200 crores to INR 6200 crores a 5 bagger in under 4 years

Value migration has played out very well however I feel the next leg of returns will come from scale

As the company becomes a INR 3000 crores or INR 5000 crores sales organisation in coming years the cost benefits would accrue and help steer market cap upwards.

If I was a new investor who has not invested in this company ? What would I do ?

Firstly you don’t have to jump and buy the company straight away the company has guided that FY25 would be a subdued year so I expect that a couple of coming quarters would be disappointing which means there would be opportunities to buy at lower then current market cap of INR 6200 crore, this is a beauty of CDMO players while Junta plays quarter on quarter game we as long term investors can play long game

Secondly keep below key Things to Track on a yearly basis when you analyse this business

1. CMS Business: The Custom Manufacturing Solutions (CMS) business is a significant growth driver, contributing close to 50% of revenues. The launch and scaling of key commercial products within this segment will be critical to watch

GDS Business: Growth in the Generic Drug Substances (GDS) business, particularly in specialty molecules like paliperidone, dorzolamide, mirtazapine, and citalopram, is important. Monitoring the development and filing of new DMFs (Drug Master Files) will be essential

3. Regulatory Approvals: Successful regulatory inspections and approvals, such as those by the FDA, are crucial. These endorsements validate the company’s operational standards and can impact future business positively

4. Operational Efficiency: Efforts to optimise costs and enhance operational efficiency remain a cornerstone of the company’s strategy. This includes managing input cost volatility and forex fluctuations

5. Pipeline Development: Tracking the progress of molecules in various phases of development, particularly those near commercialisation, will be key. The company’s ability to bring new molecules to market and scale them effectively will drive future growth

"this is a beauty of CDMO players while Junta plays quarter on quarter game we as long term investors can play long game"

This is the highlight of the article. CDMO is a lumpy business.