Q2/Q3 2024 Earnings Review - 1

I review business I am interested in quarterly, once in six months or yearly, Here is my take on each one

We will do over 3 or 4 posts in some logical grouping and as results are announced

Paypal

Google

Zomato

Technology One

E2E Networks

Laurus Labs

Ami Organics

Piramal Pharma

Neuland Labs

JM Financial

CDSL

EPCAK

Swiss Military Consumer

KPR Mills

Aditya Vision

Paypal

To understand the business read this , Q3 earnings presentation is available here and the earnings release is available here

Summary

Payment volume increased by 9%

Revenues increased by 6%

Net income decreased by 1%

EPS diluted increased by 6% due to buy back done by management, they have reduced number of shares by 7% in a year

As a investor we would like to see progress on few key variables

Increasing active account and transaction volumes

Active accounts are flat, however number of payments and transactions per active accounts are heading in right direction

Take rate improving or not declining

Paypal’s take rate is sliding down, the management indicated that Transaction take rate negatively impacted as branded checkout is becoming a lower proportion of overall revenues.

Capital allocation

Paypal is continuously using free cashflow to buy back shares which is a great use of their cash

Overall the decent quarter for them.

Google

To understand this business read this , there earnings release is available here and the Sundar’s note is available here

Summary

Revenue

Total Revenue: $85.2 billion (13% year-over-year growth)

Google Services: $76.5 billion (13% growth)

Google Cloud: $11.4 billion (35% growth)

YouTube Ads: 12% growth (brand and direct response)

Network Revenues: -2% growth

Operating Results

Operating Income: $25.9 billion (21% margin)

Net Income: $20.6 billion

Earnings Per Share (EPS): $30.69

Growth Metrics

Search Queries: Increased due to AI-powered features

YouTube Engagement: 2 billion+ monthly active users

Google Cloud Growth: 30% deeper product adoption with existing customers

Waymo: 1 million+ fully autonomous miles weekly, 150,000+ paid rides

Capital Expenditures

Q3 CapEx: $8.1 billion (data centers, AI infrastructure)

YTD CapEx: $23.4 billion

Cash and Liquidity

Cash and Equivalents: $178 billion

Free Cash Flow: $16.4 billion (Q3), $45.6 billion (YTD)

Guidance

Q4 Revenue Growth: 12-15% (year-over-year)

Full-Year CapEx: $30-33 billion

the results were better than my anticipation. For Google they key item is to check how can they combat attack on their search revenues from ChatGPT and others

The other key tracking item is monetisation of Waymo and Wing, as they will bring back top line growth to 20%+

Waymo is now a clear technical leader within the autonomous vehicle industry and creating a growing commercial opportunity.

Over the years, Waymo has been infusing cutting-edge AI into its work. Now, each week, Waymo is driving more than 1 million fully autonomous miles and serves over 150,000 paid rides — the first time any AV company has reached this kind of mainstream use.

Wing, our drone delivery company, recently passed the 1-year anniversary of scaling its partnership with Walmart in the Dallas-Fort Worth area, now operating in 11 stores and serving 26 different cities and towns.

Overall a fantastic quarter for them

Zomato

To understand the business read this ignore valuation done by Sir

Impressive topline growth continues, their earnings release can be found here

Food delivery Gross Order Value (GOV) grew 21% YoY (5% QoQ)

Quick commerce GOV grew 122% YoY (25% QoQ), and

Going-out GOV grew 171% YoY (46% QoQ); like-for-like GOV grew 139% YoY (29% QoQ)

B2B business Hyperpure’s Revenue grew 98% YoY (22% QoQ)

My thinking is that quick commerce is probably having its UPI moment, let me expand that thought.

When UPI was introduced at least I thought it would be only used for micro payments (under INR 1,000) but today I am seeing this is become default payment method for all payments under INR 100,000 - 200,000 similarly for quick commerce my initial thinking was that it would be used for small items which someone needs quickly to accomplish a task.

I think with its adoption and expanding categories it may become a default way to shop, read below deep dive

and just like UPI we have three big winners - Paytm, Phonepe and Google pay. In 4-5 years we may have 4-5 quick com players becoming very big

Technology One

Technology reports detailed results once in 6 months , my write up (paid) includes review of them. We will revisit this company in February next year

E2E Networks

This company is growing fast and thats why there is certain hype about it, you can read my take on it here

Who are they comparing themselves, clearly lofty comparison

Key Highlights

Revenue Growth: Total revenue for Q2 FY25 was ₹484 million, reflecting 120% year-over-year growth.

EBITDA Growth: EBITDA for the quarter was ₹314 million, showcasing 81% year-over-year growth with a margin of 66.1%.

Net Profit Growth: Net profit reported was ₹121 million, demonstrating 108% year-over-year growth with a 25% margin.

Earnings Per Share (EPS): Valuated EPS for the quarter was ₹7.8, marking a 98% increase year-over-year.

Fundraising: Successfully raised ₹456 million through the issue of equity shares

GPU Expansion

Recent Procurement: 256 H100 GPUs added to inventory.

Non-H100 GPU Expansion: Increased offerings of A40, A40s, L4 and L4s GPUs.

Total GPUs: Approximately 700-800 GPUs (including recent additions).

GPU Utilization Rates: Continues to see robust demand, with utilization rates although decreased from last quarter

Ground reality

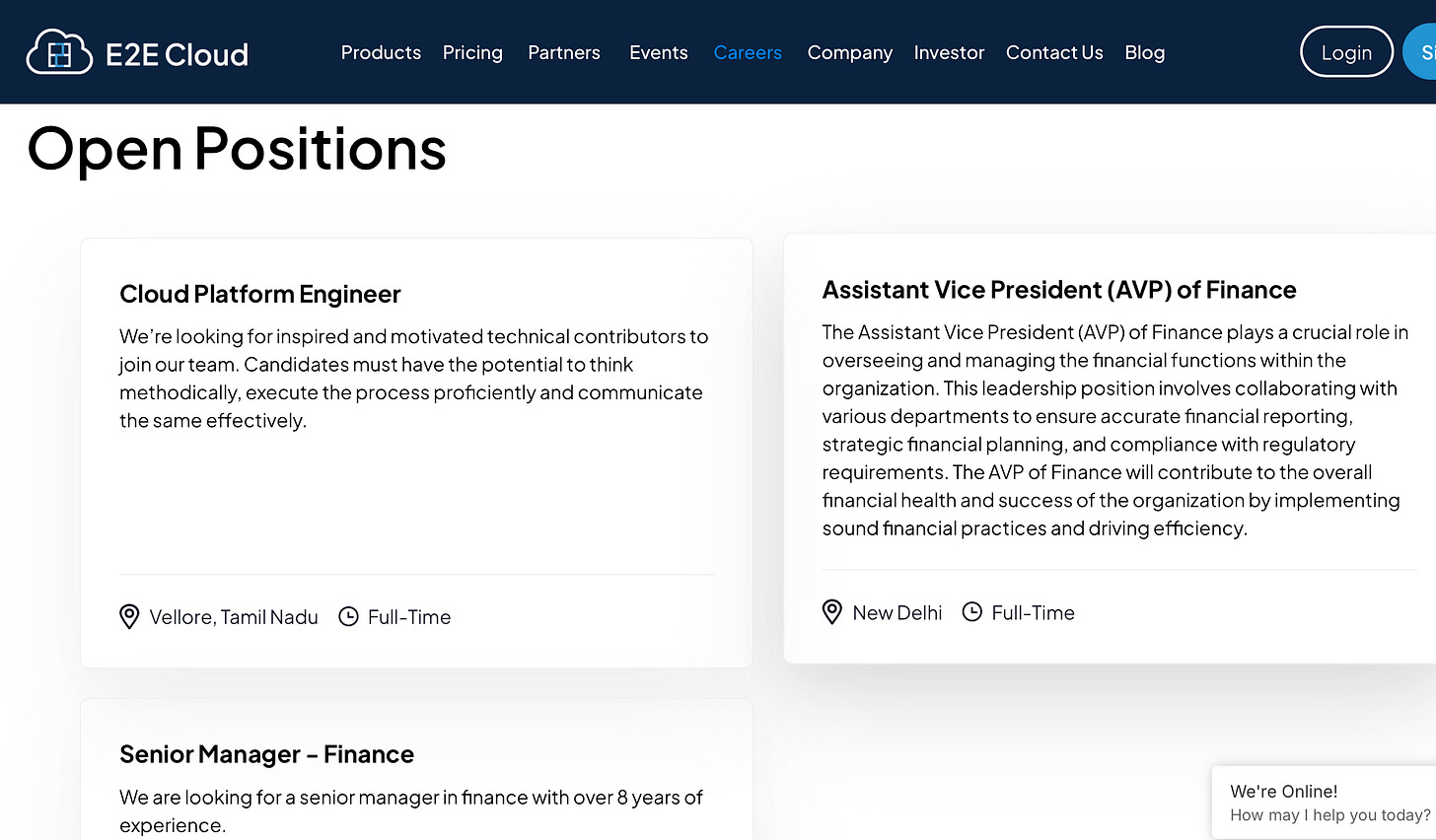

However it has only 3 open Job positions on its website, that too just 1 tech position offering 3-6 lakhs per annum. Specialized AI/ML and cloud GPU solutions require skilled professionals

I would be valuing it more as a company who is renting NVIDIA’s GPU. my assessment may be harsh or wrong

I try to end every post with something from gallery