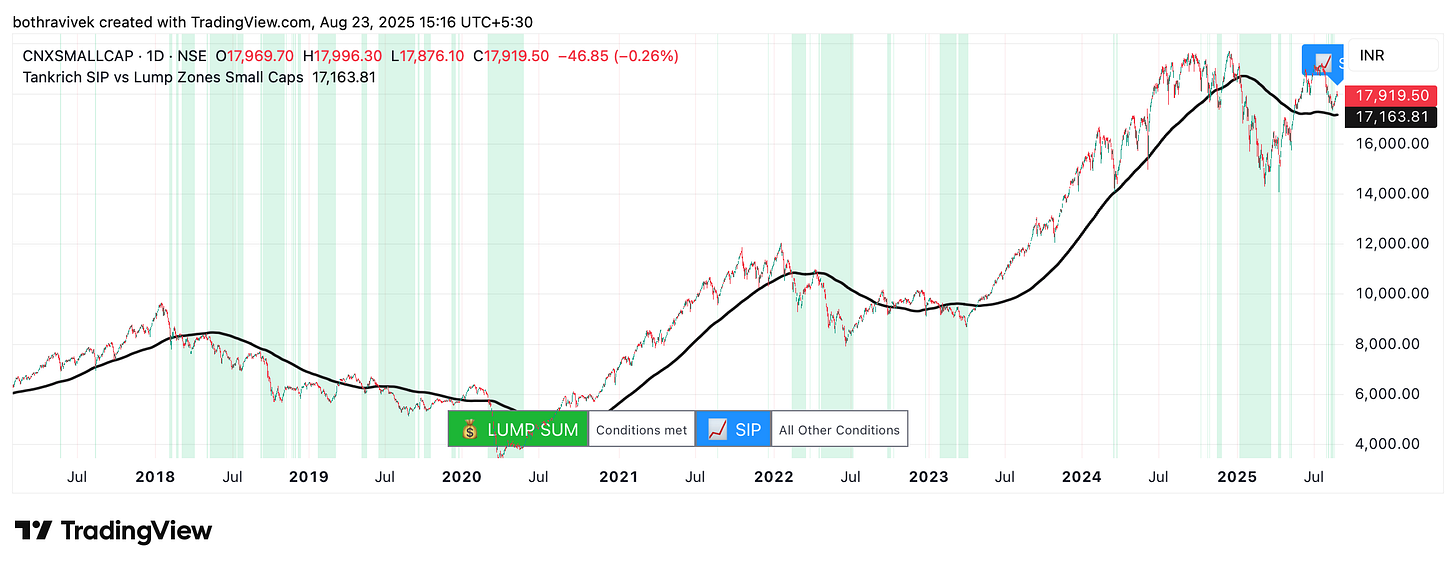

SIP vs Lumpsum

Decide with a simple system

A simple, rules based way to decide when to go SIP only and when to deploy lump sums.

If you’ve invested in Indian small caps for more than five minutes, you already know the drill: long, sleepy sideways phases punctuated by violent rallies and even sharper drawdowns. SIPs keep you in the game; lump sums can change your life if you pick your moments with discipline.

Today I’m sharing a clean, two-state TradingView overlay I use for small caps: Tankrich SIP vs Lump Zones Small Caps. It does one job very well tell you when to stay on SIPs and when to lean in with lump sums without drowning you in a dozen conflicting signals.

Why this exists

Small caps behave differently. They overshoot on the way up and down. Large-cap rules often fire too late or too rarely here.

Clarity beats complexity. The indicator only ever shows two states:

💰 Lump Sum windows (highlighted on the chart)

📈 SIP otherwise (no background highlight)

Behavior-first design. It blends a long-trend filter and a short-term momentum/pressure read so you’re not catching falling knives or chasing vertical candles.

The only caveat is that its difficult to predict if your Lumpsum window will remain short or long

What you’ll see on the chart

Green background during higher conviction Lump Sum windows

A thin moving average line for long trend context

Inline labels on the latest bars (“LUMP SUM” or “SIP”)

A compact legend at the bottom so clients and teammates immediately understand what’s going on

No clutter. No rainbow spaghetti. Just a yes/no regime.

How to use it (practical playbook)

Set your base SIP (weekly/fortnightly/monthly). Keep this running all the time.

When the chart lights up green → deploy your pre decided lump sum (e.g., 1–3× your monthly SIP).

If the highlight disappears → you’re back to SIP-only.

Evaluate at bar close (daily or weekly). Don’t let intraday noise push you around.

Pre-commit to amounts (and a max # of deployments per quarter) to keep emotions out.

Tip: Many investors prefer weekly charts for small caps. It smooths noise and still catches the meat of the move.

Who this is for

Long-horizon investors who want systematic accumulation in small caps

Advisors who need a clear, explainable rule for clients

DIY folks who like SIP as a base and tactical lump sums in down-pressure windows

What it is (and isn’t)

It is: a visual decision aid that raises the odds your lump sums go in during weakness, not euphoria.

It isn’t: a holy grail, a buy/sell trader, or financial advice. You still need allocation discipline and diversification.

How it works (high-level, no spoilers)

Uses a long-trend anchor plus a short-term pressure/relief read.

Tunes sensitivity a bit more aggressively for small-cap behavior (faster swings, deeper drawdowns).

Only when conditions align does the chart turn green for Lump Sum; everything else remains SIP.

I’m intentionally keeping the internals minimal in this post the point is the workflow, not the secret sauce as source is open sourced.

Setup (TradingView)

Open the indicator in TradingView (Pine Editor → paste → “Add to chart”).

Apply it to NSE small-cap indices (e.g., Nifty Smallcap) or your small-cap watchlist.

Inputs:

SMA length (shorter than large-cap settings—small caps move faster)

RSI length (default is standard)

Optional MACD confirmation (toggle on/off)

Default settings are balanced for daily charts; feel free to experiment on weekly.

Sensible guardrails

Cap your lump sums per quarter/year.

Diversify across categories (not just micro/small).

Keep a cash sleeve so you can actually deploy when it turns green.

Re-check position sizing after big runs.

FAQ

Does it repaint?

Signals are based on end-of-bar values. Check decisions at bar close.

Daily or weekly?

Both work. Weekly is calmer for small-cap investing; daily catches more windows

Can I use it on individual stocks?

You can, but regime tools are more robust on baskets/indices. For single names, use it as a context overlay, not a stand-alone trigger.

Can I combine with valuations?

Yes. Many investors layer this with a simple valuation dashboard (e.g., category P/E bands) to size lump sums.

Why this beats “feelings”

Most of us either:

Freeze during pullbacks (miss the best prices), or

Buy after long rallies (pay the optimism tax).

A two-state rule cuts through the noise. You save decisions for when it matters: deploy when the screen is green; SIP otherwise.

What’s next

If you found this useful, subscribe, share with a friend who’s building a small-cap corpus, and reply with your workflow—happy to include reader playbooks in the next issue.

Stay disciplined. Stay invested.

— Tankrich