Six Months at Tankrich MFD

What a Small Scorecard Can Teach Us About Process

If you do something long enough, the world will eventually give you feedback. Sometimes it comes as applause. More often, it comes as data.

We have completed six months at Tankrich MFD. And while six months is a very short time in the life of compounding, it is long enough to test whether one’s process is sensible, repeatable, and most importantly behaviourally survivable.

My only goal with Tankrich Nudges (MF clients exclusive communication group) is to compound their capital at higher XIRR to help them reach their goals faster

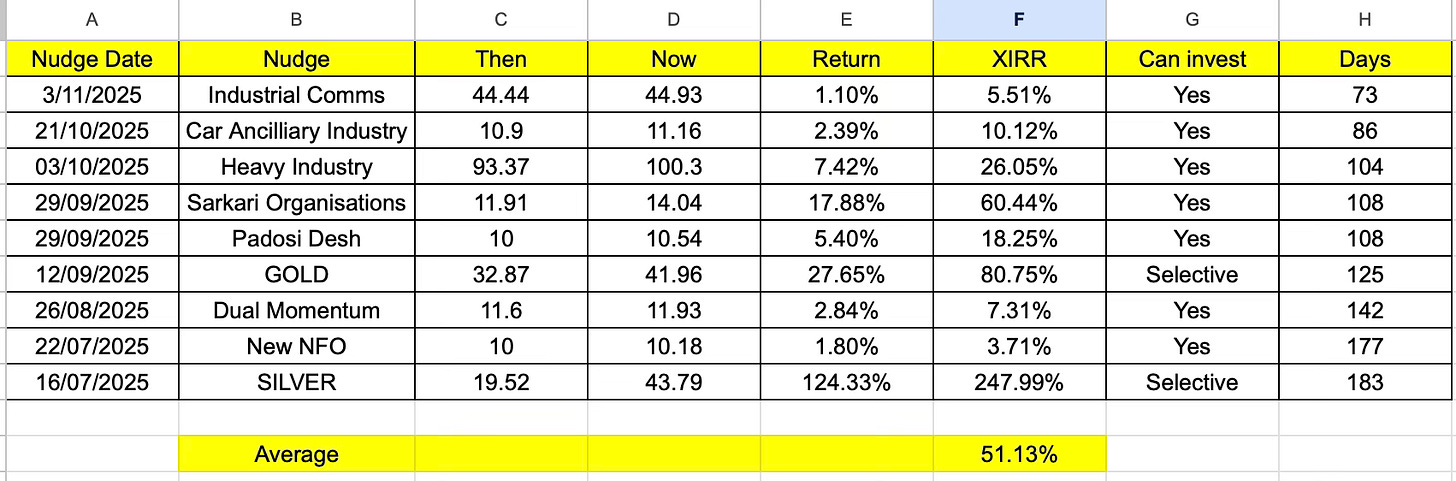

Here is what our small scorecard says.

Across ten thematic “nudges” made between mid-July and late 2025, the average XIRR works out to about 51%, over holding periods ranging from ~73 to 183 days. Some themes were tagged “Yes” (meaning: we are comfortable allocating more capital), and a couple were tagged “Selective” (meaning: proceed carefully, because price and popularity can become enemies of future returns).

Now, before the mind starts turning this into a victory lap, a few reminders are in order.

1) Good outcomes don’t always mean good decisions

Short-term outcomes are notoriously noisy. In investing, luck can masquerade as skill, and skill can look like stupidity temporarily. The right question is not “Did it work?” but “Was the decision made with the right inputs, and was the risk understood?”

Our thematic approach is not “theme-chasing.” It is a way to simplify a complex market into a few understandable narratives, then act only when the numbers and incentives line up. We are firm believers there is always a bull market somewhere

2) The biggest numbers came from the most emotional assets

The standout outcomes were from Silver and Gold:

Silver: about 124% return and ~248% XIRR over ~6 months

Gold: about 28% return and ~81% XIRR over ~4 months

These were marked Selective not because we dislike the assets, but because after large moves, the margin of safety can shrink quickly. When an asset begins to feel like a “sure thing,” it often becomes dangerous not because it will crash tomorrow, but because investor behaviour becomes fragile.

3) The “boring” themes did their job

Themes like Car Ancillaries, Industrial Comms, Dual Momentum, and the New NFO were not fireworks. They were steady.

Similarly, Heavy Industry and Sarkari Organisations delivered meaningful gains (one of them with an XIRR around 60%), but more important than the number is what it signals

cycles exist, incentives matter, and capital moves where policy and profitability align.

What we will take forward

Six months doesn’t prove anything definitive. But it does encourage us to keep doing what we already believe in:

Focus on understandable themes with real economic drivers

Enter with prudence

Track honestly

Stay humble

And avoid the most expensive emotion in the market: regret driven chasing

If we can keep clients from making the big mistakes overconfidence after wins, panic after losses then the compounding will take care of itself.

Most investing success doesn’t come from being a genius. It comes from doing a few ordinary things consistently while other people get bored, scared, or greedy.

Join 60+ families who are now working with us