Tankrich Signals

Free Forever Signals

I have often told my students that the most dangerous three inches in investing are the ones between your ears. We are wired by evolution to find patterns where none exist and to feel “FOMO” (Fear Of Missing Out) when the neighbor’s Bitcoin wallet is growing faster than our own.

The Power of the “Inversion”

Charlie Munger always said, “Invert, always invert.” Most traders ask, “How do I make the most money this month?” The Tankrich system asks a much more important question: “How do I avoid being decimated?” By utilizing a systematic “In/Out” signal for volatile assets like Bitcoin, Silver the practitioner is practicing Capital Preservation. It is the recognition that in a game of high variance, the winner is often the one who simply refuses to play during the typhoons. This works for GOLD too cause it can do nothing for years

The Math of the “Fat Tail”

We live in a world of Non-Ergodicity. In plain English: if you go bust once, you are out of the game forever. Tankrich’s focus on Trend Following is an acknowledgement of “Fat Tails.” It doesn’t try to predict the bottom; it waits for the trend to prove itself.

If you have a process that is backtested, disciplined, and removes the "Self" from the equation, you have already won half the battle.

The Tankrich Signals platform it is an extension of a math-driven, trend-following philosophy designed to keep investors on the right side of the market.

Refreshed every week

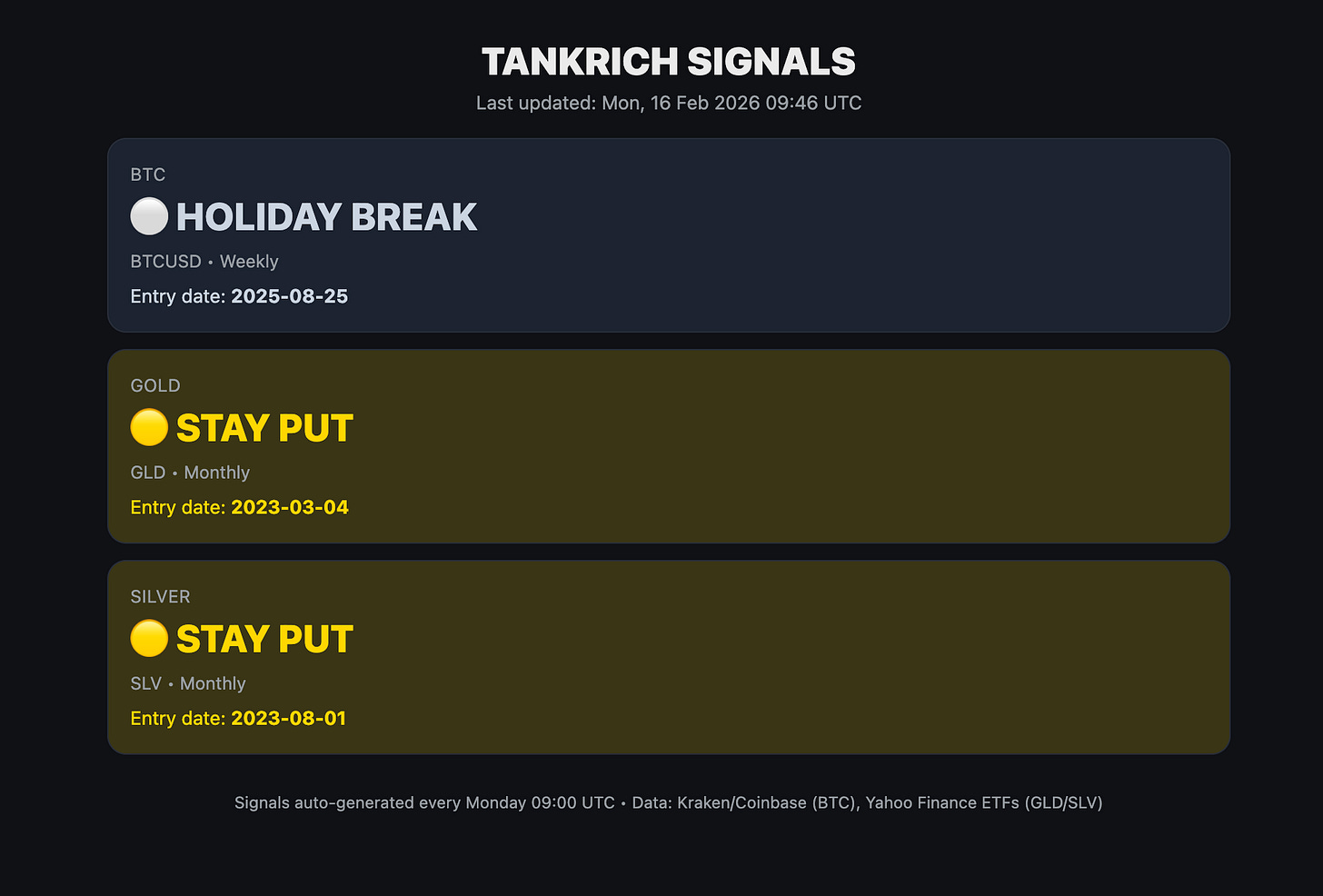

How to Interpret

WAKE UP - The model has detetcted a trend

STAY PUT - Trend persists

RUN AWAY - Trend ends

HOLIDAY BREAK - Waiting for Trend

A Necessary Warning on the Limits of Models

In the spirit of Charlie Munger, I must remind you that a tool is only as good as the hands that wield it. While the systems discussed at Tankrich Signals provide a logical filter to navigate the “fat tails” of the market, they are not a substitute for your own independent thinking. No mathematical model, no matter how elegant or backtested, can account for the “Unknown Unknowables” or the sheer unpredictability of human folly on a global scale.

One must never mistake the map for the territory. The signals provided are a reflection of past probabilities, not a crystal ball for future certainties. You should assume that the risk of loss is permanent and that markets can remain irrational far longer than you can remain solvent.

Bookmark and consider subscribing as more stuff is coming your way!