The most unlucky investor

A tale from 2008 financial crisis

A young professional with hard work and some luck accumulated some decent dollar savings, and things were looking rosy both the S&P 500 and Nifty 50 in India have made their lifetime highs, The young professional who has spent the last 15 years in the USA decided to move back to India, On his 40th birthday in December 2007 he called quits to his accomplished corporate life and set sail

To fund his semi-retirement with 2 young kids, he decided to invest all his savings in equity markets via a single mutual fund. He had few rules

No withdrawal for his 1st year, he is going to live at his parent’s place with minimal outlay in year 1

In years 2-7, he will withdraw 4% of his lifetime savings

In years 8-13, he will withdraw 15% more than as kids move to secondary or tertiary education

13 years onwards withdrawal would be reset to 4% every 5 years and reviewed thereon funds permitting

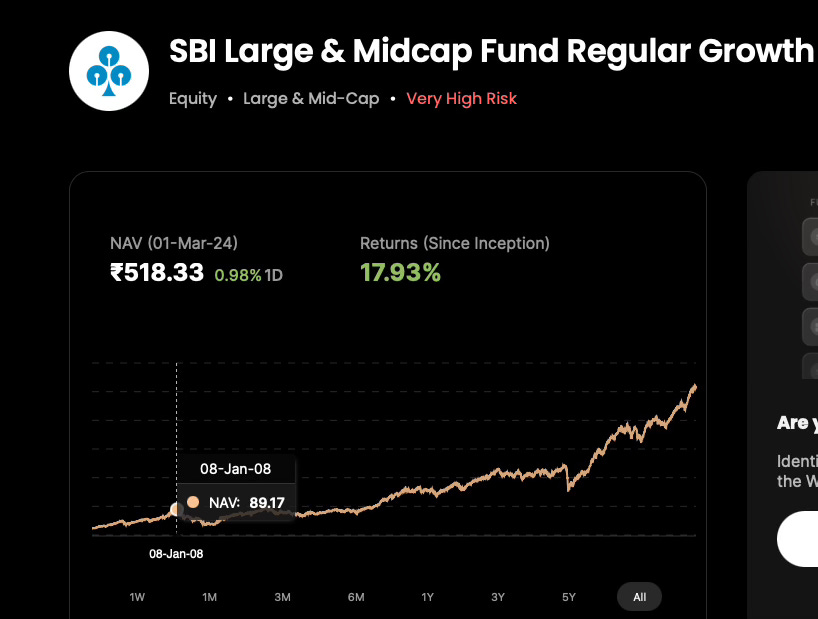

In Jan’08 he invested INR 3 crore in SBI Large and Mid Cap regular fund, the NAV at that time was INR 90 per unit, the year rolled by the family settled in India after a long stint in the USA, old habits were re-learned new habits were discovered and adopted.

The shock

In Jan’09 while this professional was busy setting up his new life, the world entered into a huge depression and his honeymoon period was over too, he went to his advisor and asked him how are his investments doing?

SBI Large and Mid Cap regular fund, the NAV at that time was INR 40 per unit, in a year while this professional was busy setting his new life, his lifetime savings were reduced in half. There was shock and disbelief. The professional after making impressive decisions all his corporate life may have squandered his savings. His advisor asked him to stay put.

Stuck to his plan

He executed his plan, he withdrew INR 100,000 per month totaling INR 12,00,000 which was 4% of his corpus, and went about building things he was passionate about without looking at the NAV of his fund

In December 2014, he increased the withdrawal rate to INR 115,000 per month which increased to INR 170,000 per month in 2020

To his surprise even with a huge drawdown in year 1, today his corpus sits at INR 8.77 crore

Here is how his corpus grew after planned withdrawals

2008: INR 3 crore

2014: INR 3.7 crore

2020: INR 5.16 crore

2023: INR 8.77 crore

growing at 7.5% CAGR despite a huge drawdown at the end of year 1.

What did you learn?

SWP calculations made on SBI MF website

Image source: https://www.dezerv.in/mutual-funds/sbi-large-midcap-fund-regular-growth-inf200k01305/

Agree and also sticking to plan and some great advise

That if it is a growing economy with healthy equity returns , you can withdraw even at a rate slightly greater than inflation and the natural growth of the corpus will leave you with more money than you started with , even allowing for huge crashes and medium corrections along the way.