The Nine Box Investment Charter

A Framework for Investment Temperament

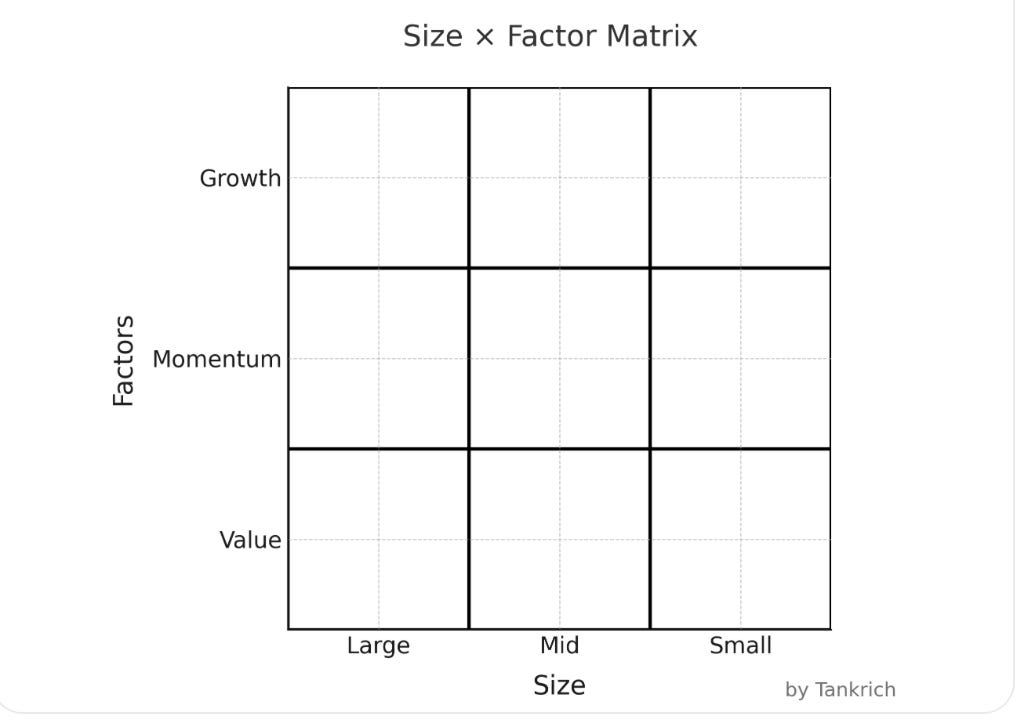

Almost all equity investing can be decomposed to this 3X3 GRID

Charlie Munger once observed that the human brain has evolved to handle a limited number of variables simultaneously. When faced with thousands of investment choices, most investors either suffer from analysis paralysis or, worse, make decisions based on recent performance or compelling narratives.

The nine-box matrix solves this by providing what can be called a "constrained optimization framework"limiting your choices to nine distinct categories while ensuring comprehensive coverage of investment opportunities. This is similar to how Warren Buffett constrains his universe to businesses he can understand, or how Benjamin Graham constrained his to statistical bargains.

The Latticework of Investment Styles

Munger's concept of mental models as a latticework applies beautifully to portfolio construction. The nine-box matrix represents such a latticework, where each box serves as a different lens through which to view market opportunities.

Consider this: When Infosys was a small-cap growth stock in the early 1990s, it served an entirely different portfolio function than it does today as a large-cap dividend-paying stock. The company evolved through different boxes over time, and investors who owned it throughout benefited from this evolution.

This temporal migration between boxes is not a bug it's a feature. Companies naturally progress from small to large, from growth to value, and sometimes catch momentum along the way. By maintaining exposure across all boxes, you position yourself to benefit from this natural business lifecycle.

The Inversion Principle Applied

Let's invert the question. Instead of asking "Why should I own all nine boxes?", ask "What happens if I don't?"

If you only own large-cap stocks, you miss the wealth-creating phase of tomorrow's large companies. Bajaj Finance was once a small-cap. Page Industries was once a mid-cap. Asian Paints was once a growth story that value investors avoided because of its "expensive" valuations.

If you only own value stocks, you miss secular growth trends. Technology, consumption, and healthcare have created enormous wealth over decades, often trading at seemingly expensive multiples. Value investors who avoided these sectors in the name of "discipline" paid an opportunity cost.

If you only own growth stocks, you're vulnerable to style reversals. The dot-com crash of 2000-2002 reminded growth investors that trees don't grow to the sky. Mean reversion is a powerful force in markets.

The nine-box approach acknowledges our inability to predict which style will outperform and instead focuses on not missing out on major wealth-creating opportunities.

The Competitive Advantage of Temperament

Successful investors share one key trait: the greatest competitive advantage is not analytical ability or information access it's temperament. Specifically, the ability to hold positions that are temporarily out of favor while maintaining conviction in long-term outcomes.

Each box in the matrix will periodically disappoint you. Small-caps will underperform for years. Value will seem permanently broken. Growth will appear unsustainably expensive. This is when temperament becomes crucial.

The nine-box framework provides what we might call "temperamental diversification." When one part of your portfolio is causing anxiety, other parts provide comfort. This emotional hedging is perhaps more valuable than the financial hedging, as it allows you to maintain a long-term perspective during short-term turbulence.

The Concept of Antifragility in Portfolio Construction

Nassim Taleb's concept of antifragility systems that get stronger from stress applies beautifully to the nine-box framework. Instead of trying to predict and protect against specific risks, you build a portfolio that benefits from volatility and uncertainty.

When markets crash, your value positions often perform better. When economies boom, your growth positions capture the upside. When sectors rotate, you have exposure to the incoming favorites. When small companies are discovered by institutions, you participate in the revaluation.

This isn't just diversification it's positioning yourself to benefit from the inherent volatility and unpredictability of markets rather than being harmed by them.

The Second-Order Thinking Framework

First-order thinking says: "This large-cap value stock is cheap, so I should buy it."

Second-order thinking asks: "Why is it cheap? What would make it expensive? How does it fit with my other positions? What happens to my portfolio if this entire category underperforms?"

The nine-box matrix forces second-order thinking by making you consider not just individual securities, but how different investment styles interact within your portfolio. It's a systems-thinking approach to portfolio construction.

The Behavioral Finance Perspective

Daniel Kahneman's research on behavioral biases reveals why most investors fail to maintain diversified portfolios:

Recency bias: We overweight recent performance

Confirmation bias: We seek information that supports our existing positions

Overconfidence: We believe we can predict which style will outperform

The nine-box framework acts as a behavioral guard rail. It forces you to own positions that feel uncomfortable (the currently underperforming boxes) while preventing over-concentration in what feels comfortable (the recently outperforming boxes).

The Patient Capital Advantage

Long-term wealth creation in markets reveals a consistent pattern: the greatest returns come from being patient capital in a world of impatient speculators. The nine-box approach embodies this philosophy.

Most investors jump between styles chasing performance. They sell small caps after they've underperformed to buy large-caps after they've outperformed. This is exactly backward buying high and selling low with extra steps.

Patient capital does the opposite. It maintains consistent exposure across styles, rebalances periodically, and allows compound growth to work across different business models and market conditions.

The Optionality Framework

Each box in the matrix provides different types of optionality:

Small-cap positions provide optionality on future growth and discovery by larger investors

Value positions provide optionality on mean reversion and business turnarounds

Momentum positions provide optionality on trend continuation and institutional flows

Growth positions provide optionality on secular trends and business model scalability

Rather than trying to predict which options will pay off, you maintain a portfolio of options across different scenarios. This is similar to how venture capitalists approach portfolio construction not every investment will succeed, but the successes can more than compensate for the failures.

The Circle of Competence Evolution

Buffett and Munger emphasize staying within your circle of competence. But here's an important insight: your circle of competence should be expanding over time, and the nine-box matrix facilitates this expansion in a structured way.

As you gain experience with different investment styles, you develop competence in recognizing opportunities across various market conditions. What starts as mechanical diversification evolves into intuitive understanding of how different business models create value under different circumstances.

The Compound Learning Effect

Each box teaches different lessons:

Value investing teaches patience and contrarian thinking

Growth investing teaches how to evaluate future potential and pay for quality

Momentum investing teaches market psychology and timing

Size diversification teaches how scale affects business dynamics

These lessons compound over time, making you a more complete investor. Someone who has only practiced value investing might miss growth opportunities. Someone who has only chased momentum might panic during volatility. The nine-box approach provides a comprehensive education in market behavior.

The Risk Management Philosophy

Traditional risk management focuses on volatility reduction. But volatility isn't risk permanent loss of capital is risk. The nine-box framework addresses this by ensuring you're never completely wrong about market direction.

If you're 100% in value stocks and we enter a sustained growth market, you suffer permanent opportunity cost. If you're 100% in small-caps and we enter a risk-off environment, you suffer permanent capital loss. The nine-box approach prevents these concentration risks while maintaining upside participation.

The Practical Implementation Framework

Theory without practice is useless. Here's how to implement the nine-box approach:

Acknowledge your biases: We all have style preferences based on temperament and experience

Start with desired weights: May be 11.1% in each box, adjusted for your risk tolerance

Rebalance systematically: Annually or every 3 years, selling outperformers to buy underperformers

Focus on fund selection within boxes: Choose high-quality fund managers for each category

Monitor but don't micromanage: Review performance annually, adjust weights based on changing circumstances

The Long-term Perspective

Wealth creation over decades reveals a consistent pattern: successful investors share one trait they remain invested through all market cycles. The nine-box matrix facilitates this by ensuring that something in your portfolio is always working, even when most things aren't.

This isn't about maximizing returns in any single period it's about maximizing the probability of achieving your long-term financial objectives while maintaining the emotional equilibrium necessary to stay invested.

Conclusion: The Wisdom of Humility

The nine-box matrix embodies the intellectual humility that characterizes great investors. It acknowledges that we cannot predict the future, cannot time markets perfectly, and cannot consistently pick winning styles.

Instead of trying to be brilliant, it focuses on being systematically sensible. Instead of seeking maximum returns, it seeks maximum probability of achieving acceptable returns over long periods.

This approach won't make you rich overnight. But it might make you wealthy over decades, which is far more valuable.

As Munger reminds us, "

It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent."

The nine-box matrix is a framework for being consistently not stupid about portfolio construction.

This is what I try to with all my mutual funds client’s portfolio. Need help book a discovery call