Everything is Cyclical

Collections of pictures, charts , stats

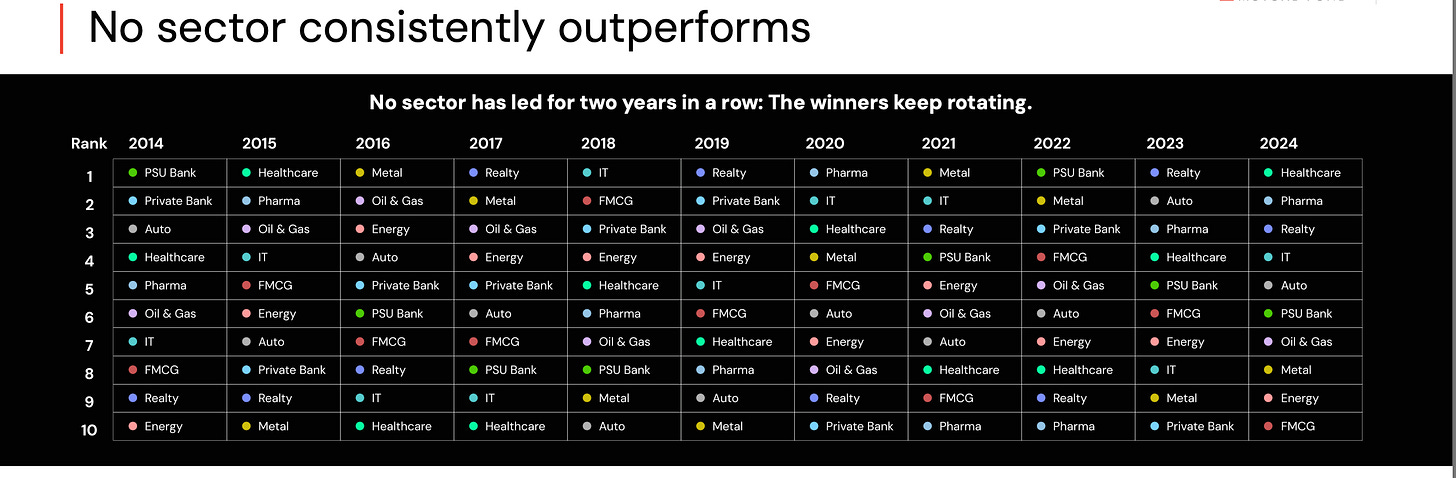

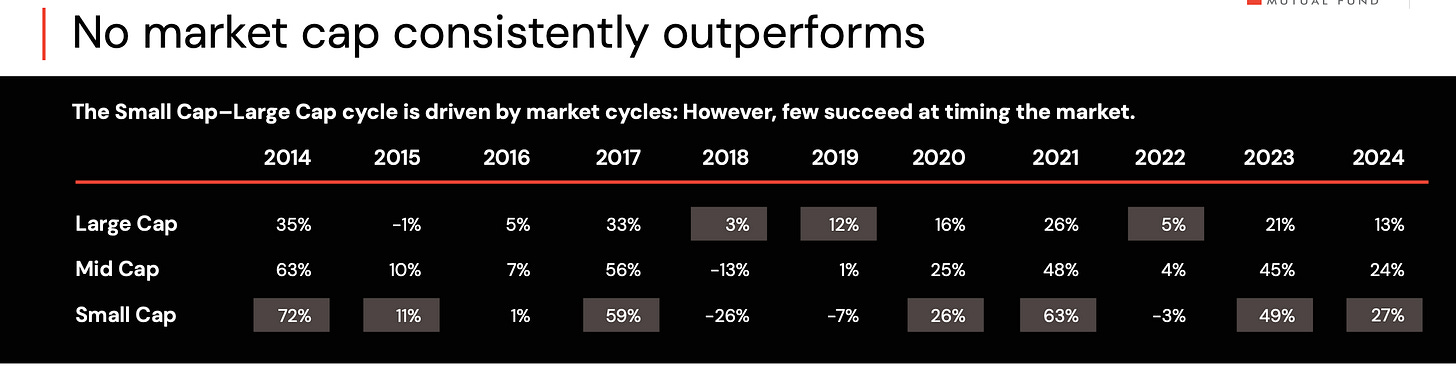

Winners always rotate1

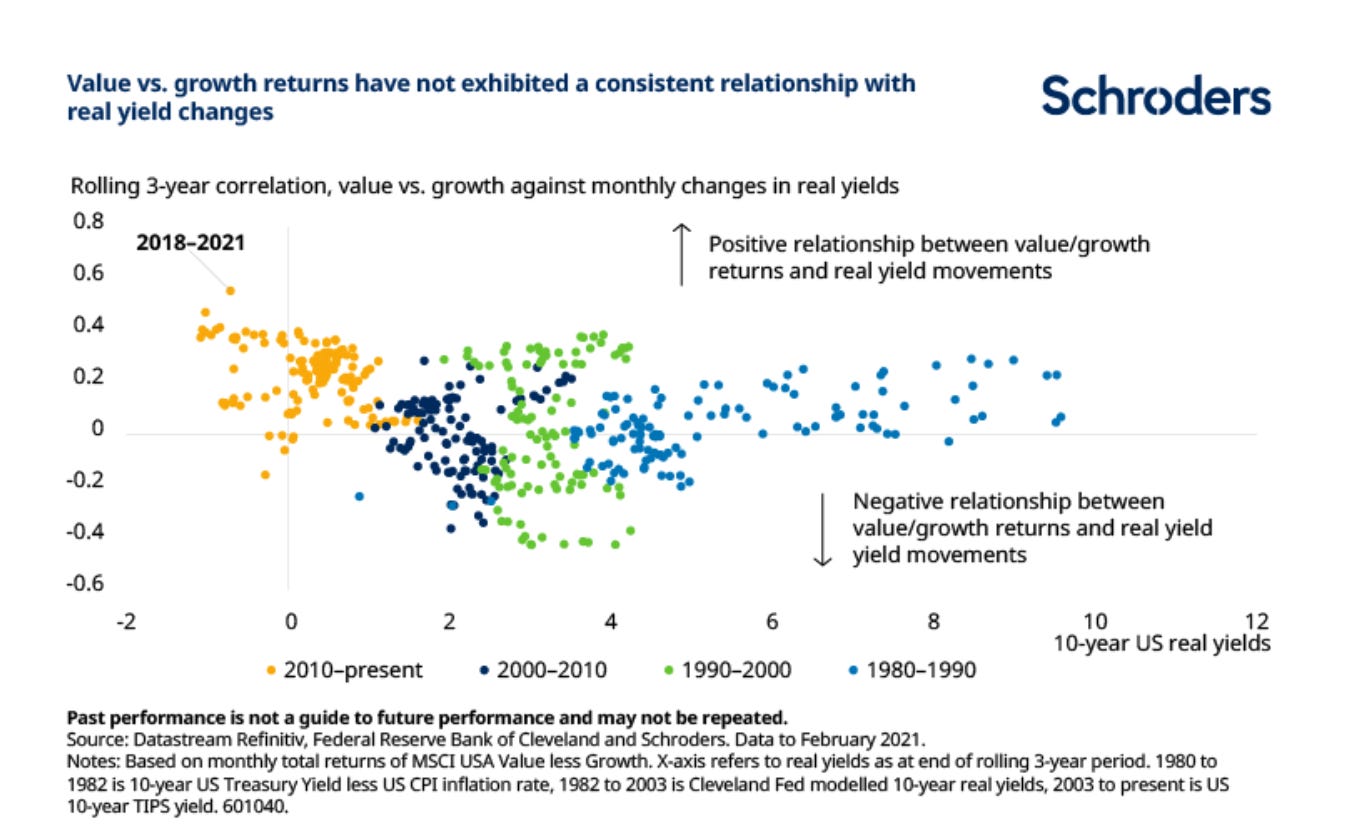

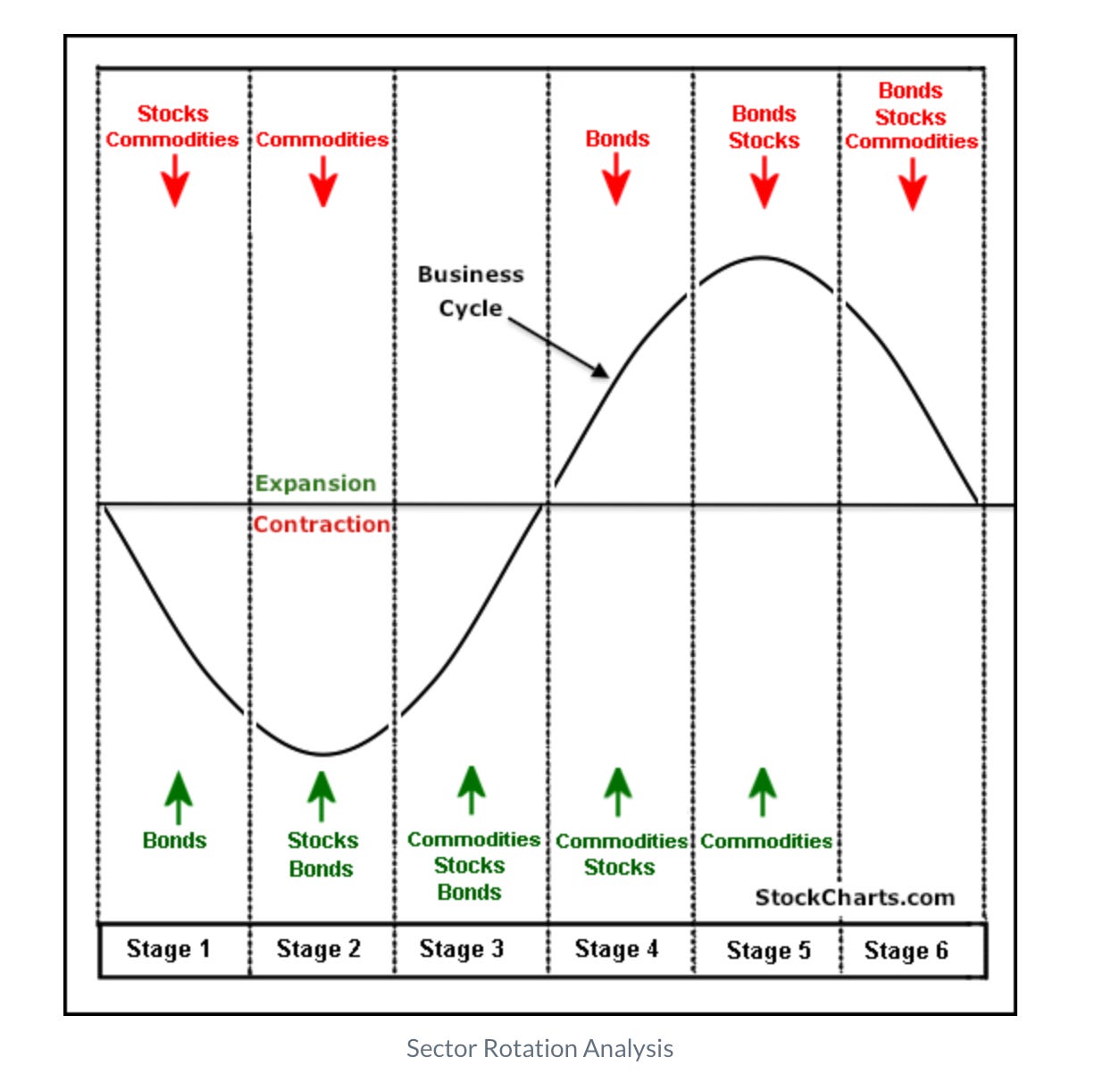

Like Seasons factor yielding returns change2

A good analyst should be always looking at business cycles to spot them3

its been proven by formal research

The emerging evidence suggests that within the European market, sector rotation strategies tend to produce returns above the average benchmark, both during contractionary and expansionary monetary policy regimes, while excessive returns within both the US and European markets are observed.4

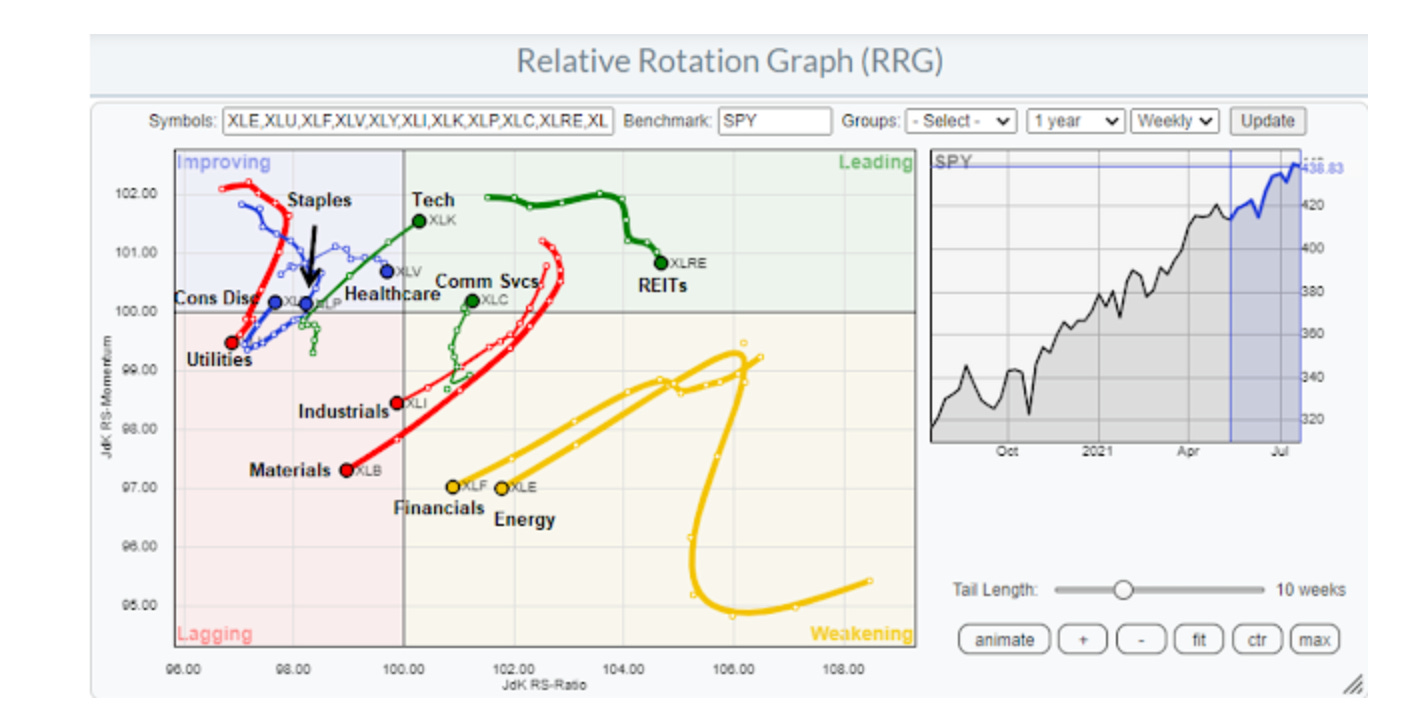

Want to learn how to spot - Start with RRG relative rotation graph5

We use systems to track these rotation !

https://unifimf.com/wp-content/uploads/fund-sheets/Unifi-Flexi-Cap-Presentation-Full-version.pdf

https://www.schroders.com/en-us/us/local/insights/what-really-drives-rotations-from-growth-to-value-stocks/?utm_source=chatgpt.com

https://chartschool.stockcharts.com/table-of-contents/market-analysis/sector-rotation-analysis?utm_source=chatgpt.com

https://link.springer.com/article/10.1057/s41260-020-00161-6?utm_source=chatgpt.com

https://humblestudentofthemarkets.com/2021/07/31/sector-review-balanced-leadership-and-rotation/?utm_source=chatgpt.com