ITD Cementation

Child has overtaken Parent

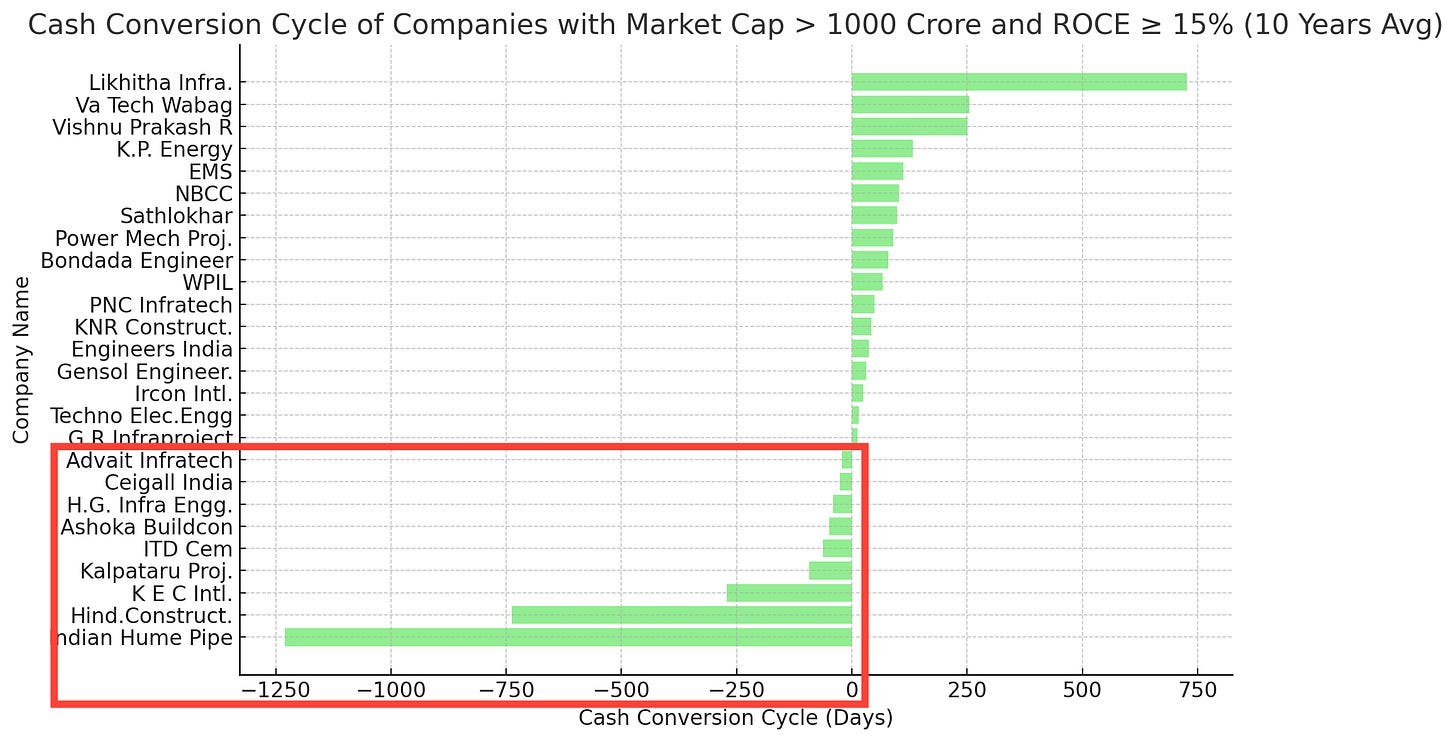

One thing I look for in companies is there Cash Conversion Cycle (CCC), there are only a handful companies that have zero or negative CCC

The Cash Conversion Cycle (CCC) is an important metric because it measures how efficiently a company manages its working capital. Specifically, it tracks the time (in days) it takes for a company to convert its investments in inventory and other resources into cash flow from sales

A shorter CCC indicates that a company quickly sells inventory, collects receivables, and pays suppliers, optimising working capital. This improves liquidity, operational efficiency, and cash flow management, allowing the business to meet short-term obligations, reduce costs, and invest in growth. Ultimately, the CCC helps gauge a company's financial health and ability to sustain operations while maintaining a competitive edge.

In India there are 100+ physical infrastructure development companies but only few have been able to earn an average 10 year ROCE of 15%+ and keep cash conversion ratio below 0

What stood out for ITD Cementation is its parent company

Italian Thai Development Public Company Ltd (ITD, Bangkok). It is amongst the leading infrastructure & construction company in Thailand.

However the parent company is now struggling

Italian-Thai Development plc (ITD) is one of Thailand’s largest construction firms. It is certainly dealing at this time with a severe financial crisis.In brief, this is now common knowledge along with the delayed payments to its workforce and subcontractors1

In 2023, the company reported a loss of 45 million baht in Q3 despite generating 47 billion baht in revenue for the first nine months of the year,One major contributor to this crisis is the company's heavy investments in international projects, such as the Dawei project in Myanmar, where ITD has already invested 7-10 billion baht without significant progress, largely due to the country's political instability. ITD has also faced challenges in domestic projects like the potash mining project in Udon Thani

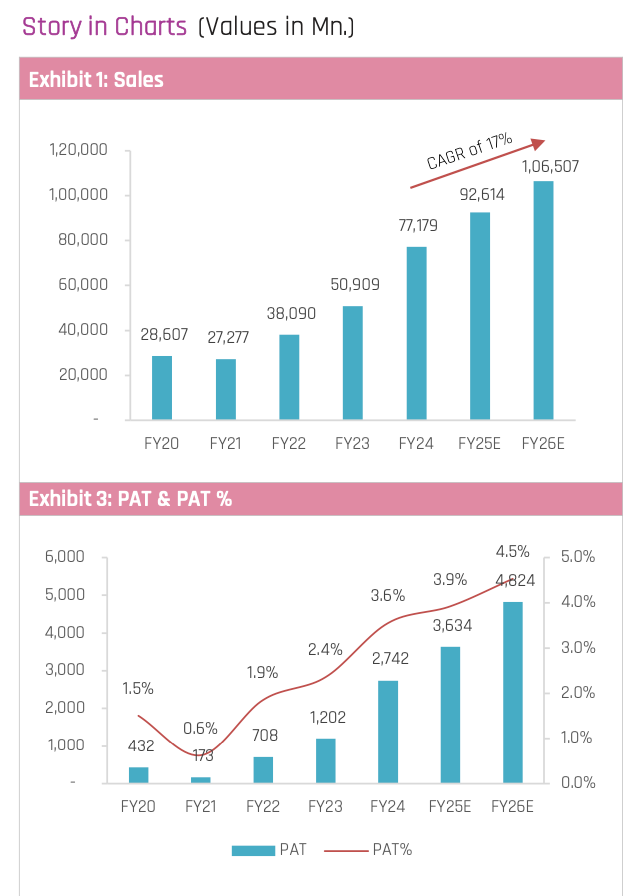

On the other hand it’s Indian subsidiary (NSE: ITDCEM) is doing very well, Sales, Profits and profit margins all have been heading in right direction2

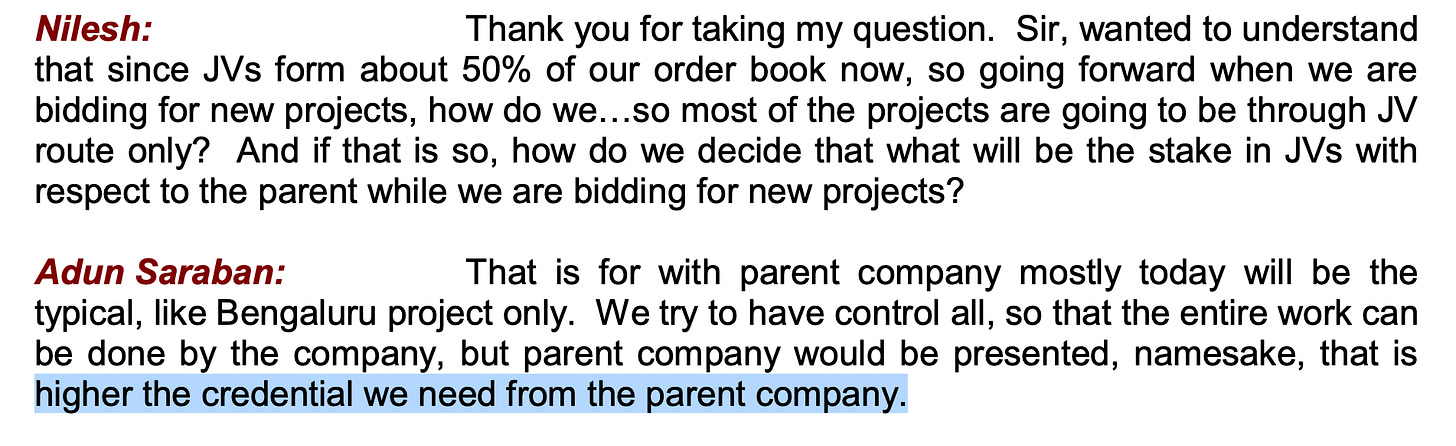

But apart from numbers the most important change has been the commentary on relationship with parent, In past the company was dependent on its parent company to get big high profile projects3

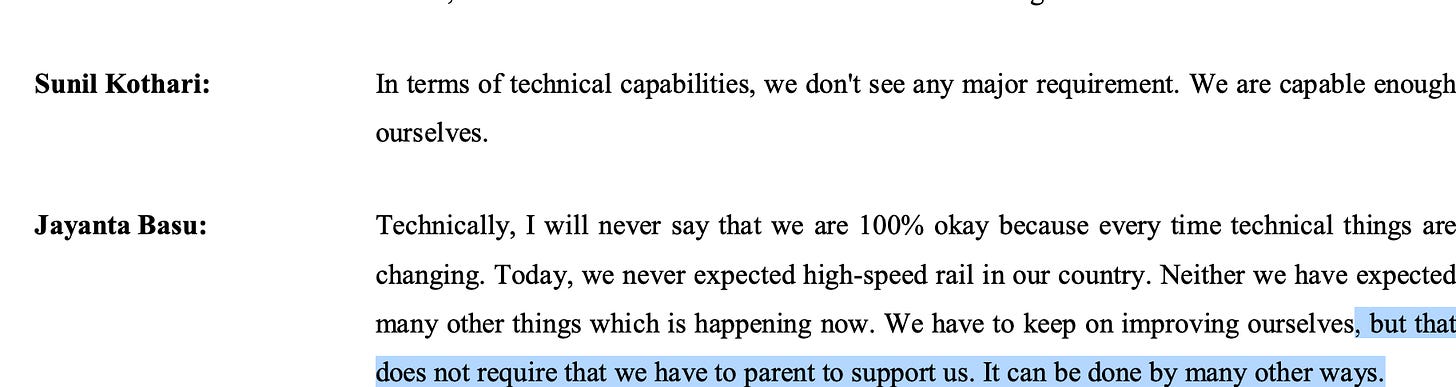

But today the tone is very different and company is confident to run on its own independent of parentage4

As India continues to invest heavily in infrastructure to catch and lift millions out of poverty, companies like ITD Cementation should have plenty of orders coming.

I dont have a position in stocks I wrote this post to expand my knowledge in this sector.

Before you go our next free online community event is on ways to tackle cost of living crisis, if you like to attend

I am going to end every post with something from my photo gallery

https://www.thaiexaminer.com/thai-news-foreigners/2024/03/25/giant-italian-thai-firm-fights-for-survival-and-to-pay-wages-fears-for-wider-economy/#google_vignette

https://www.investmentz.com/ResearchReport/InvestmentIdeaOldDownload?fileName=Investment%20Idea_ITDCEM_2024-06-05.pdf

https://www.itdcem.co.in/wp-content/uploads/2017/09/Transcription-of-ITD-Cementation-Conference-Call-held-on-10.08.2017-at-10.30-AM-IST.pdf

https://www.bseindia.com/xml-data/corpfiling/AttachLive/e4314898-7c05-4938-8ba7-5db991b90f48.pdf