Powergrid InvIT

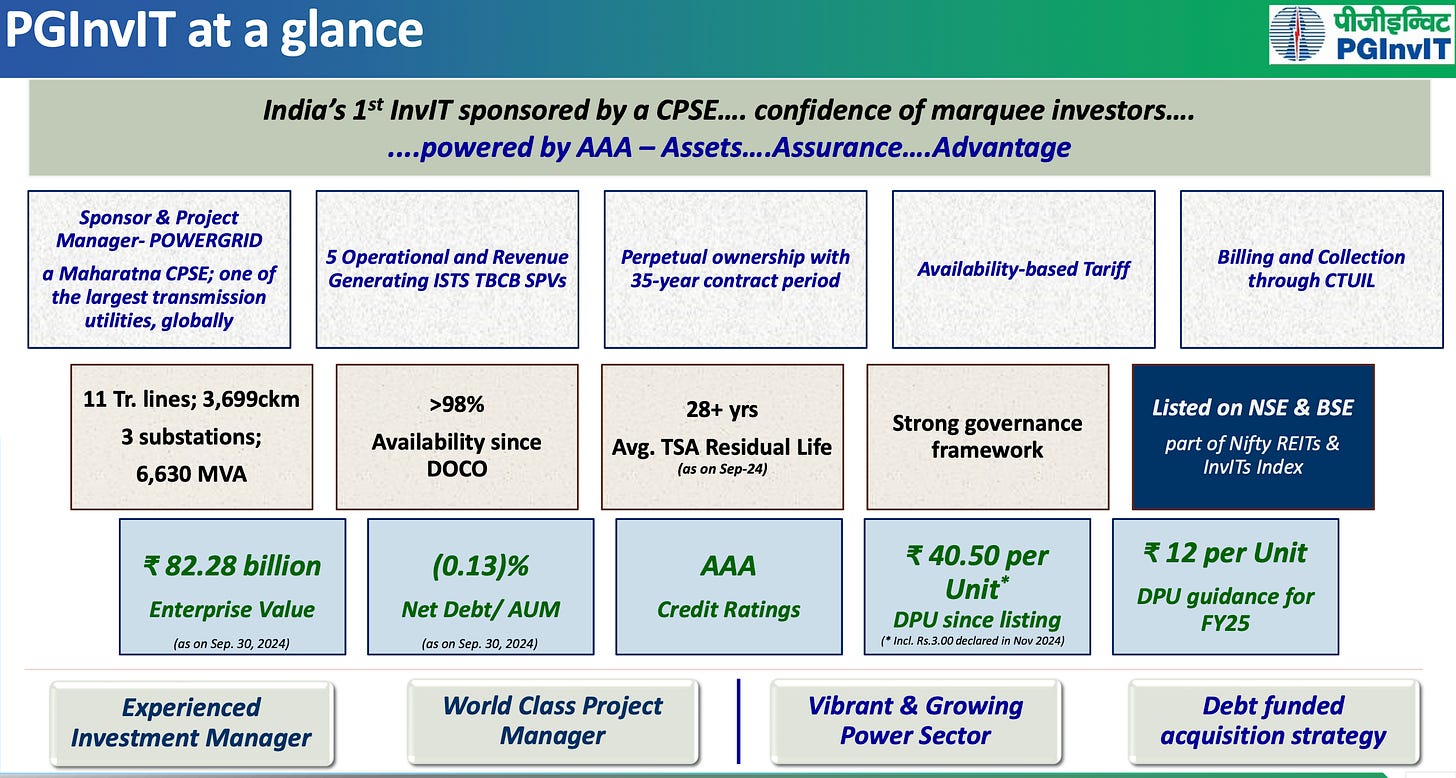

Powergrid InvIT (Infrastructure Investment Trust) owns, constructs, operates, maintains, and invests in power transmission assets in India. The below slide from their investor presentation provides a good overview of this InvIT1

Unlike its Peer IndiaGrid the PGInvIT unit holders are having a rough time, in this post we would like to conclude if this InvIT has trapped its unit holders with dreams of “better than FD” returns

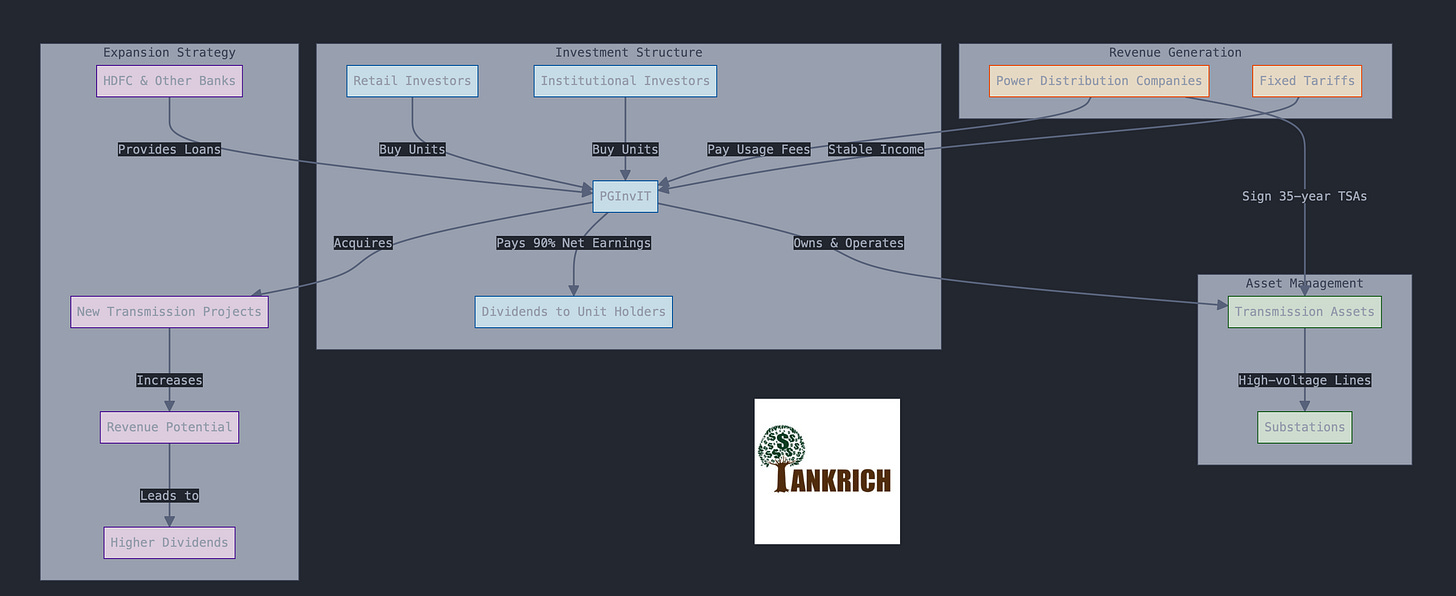

Before we talk specifically about PGInvIT lets understand Transmission Service Agreement which is a key element of an InvIT’s revenue model

Transmission Service Agreements (TSAs) in India typically have a term of 35 years, during which the Transmission Service Provider (TSP) is entitled to receive fixed annual transmission charges as determined through a competitive bidding process.

Under a TSA, power distribution companies pay a pre-agreed tariff fee to use the transmission network over a 35-year period

Hold this point in mind as discuss PGInVIT further , the revenue of PGIInVIT is fixed for 35 year period , there may be small variances to revenue as Government offers incentives if lines are up and running for more than 98% of time

Although the TSA for these providers is not available in public domain, their revenue and free cashflows projections are available every year twice in the valuation reports published by the InvIT. For this trust the latest valuation report can be downloaded from here

This InvIT has taken a massive beating, the unit price is down at 81 from High of 140 per unit in 2022

There are several reasons why the unit price is on one way downtrend

The payout would reduce after FY 2026, if one goes by latest valuation report then the drop would be steep from INR 12 per unit per year DPU (Distribution per unit) to INR 10 based on my calculation

No new projects have been added while on other hand Indiagrid is continuously adding new projects and increasing DPU

PSU Power Grid is not transferring any new asset to InvIT, initially people thought all of the new Power Grid projects will eventually end up with PGInvIT

PSU management doing PSU things - sitting on ass and collecting their paychecks, see below extract from Concall

Even though the management is average the assets are very good and have predicable cashflows without much upkeep so its a classic case where Buffett says even an idiot can run the business

In latest development The InvIT has acquired 26% stake in remaining four special-purpose vehicles (SPVs) - POWERGRID KalaAmb Transmission Ltd, POWERGRID Jabalpur Transmission Ltd, POWERGRID Warora Transmission Ltd and POWERGRID Parli Transmission Ltd, from Power Grid Corporation of India Ltd on December 30, 2024, for a consideration of Rs 506.63 crore. This acquisition was completely finances by Debt

So from Jan 2025 all 5 assets are now completely owned by InvIT, I think they will be DPU accretive assuming the finance terms with HDFC are similar to their 2022 transaction2

My approach to estimating payout for future DPUs

Took free cash flow from Sep 2024 valuation report

Adjusted it for Dec 2024 acquisition

Assumed similar finance arrangements with HDFC as their 2022 transactions

The projection are available here

if my projections are correct then at Unit price of INR 81, it is having an long IRR of 14%+ not bad for retirees

a lot can go wrong with long cash flow projections, also remember today’s INR 10 DPU is widely different from INR 10 DPU from 2058

there is some positive optionality as well

They made add more projects if there is push from GOI

However, between 2022 and 2027, the country plans to add approximately 1,14,687 circuit kilometres of the transmission line, 7,76,330 MVA of transformation capacity at 220 kV level and above. From 2027 to 2032, an addition of 76,787 circuit kilometres of transmission lines and 4,97,855 MVA of transformation capacities are expected to be added. With these substantial investments in the sector, we expect that these projects reach commissioning, they will present acquisition opportunities for investment vehicles like PGInvIT seeking revenue generating assets3

Potential new revenue stream, Telecom service providers can now lease fibres on OPGW of transmission service providers, instead of leasing bandwidth.4

Low Interest rates help to improve bottomline and increase DPUs to unit holders

please use your own due diligence before investing

https://www.pginvit.in/uploads/069c138c-d1ab-4748-9a25-9fba06f4118c/Investor_Presentation_Q2FY25_Final_V4.pdf

May 2022 Term Loan:

Amount: ₹700 crore

Purpose: To acquire the remaining 26% stake in POWERGRID Vizag Transmission Limited (PVTL) and POWERGRID Kala Amb Transmission Limited (PKATL), and to acquire additional revenue rights in POWERGRID Warora Transmission Limited (PWTL), POWERGRID Parli Transmission Limited (PPTL), and POWERGRID Jabalpur Transmission Limited (PJTL) from PGCIL through the respective SPVs.

Tenure: 16 years (door-to-door)

Interest Rate: Floating rate linked to the three-month Treasury Bill (T-Bill) rate.

Average Cost of Debt: For the first half of FY24, the average cost was 8.18%.

Repayment Structure: Elongated repayment schedule leading to a comfortable projected debt service coverage ratio (DSCR).

Additional Provisions: Includes a waterfall mechanism and the maintenance of a Debt Service Reserve Account (DSRA) equivalent to one quarter's debt servicing.

These terms reflect PGInvIT's strategy to structure its debt with favorable terms, ensuring manageable repayment schedules and leveraging floating interest rates to potentially benefit from favorable market conditions.

https://www.pginvit.in/uploads/1b1a881f-aab8-4d8f-ba80-9dbf7ec1e081/Conference_Call_-_Text_Transcript-on_Q2_&_H1_FY25.pdf

https://www.tndindia.com/cea-recommends-higher-capacity-opgw-in-transmission-lines/

Other reference material used

https://www.screener.in/company/PGINVIT/#chart

https://www.crisil.com/mnt/winshare/Ratings/RatingList/RatingDocs/POWERGRIDInfrastructureInvestmentTrust_January%2010_%202025_RR_360678.html#:~:text=The%20InvIT%20has%20acquired%2026,A1%2B')%20on%20December%2030%2C

https://www.crisil.com/mnt/winshare/Ratings/SectorMethodology/MethodologyDocs/criteria/CRISILs%20rating%20criteria%20for%20REITs%20and%20InVITs.pdf

https://www.pginvit.in/uploads/069c138c-d1ab-4748-9a25-9fba06f4118c/Investor_Presentation_Q2FY25_Final_V4.pdf

https://forum.valuepickr.com/t/pginvit-impairment-of-investments-in-subsidiaries-and-book-value/110498/26

https://www.hdfcsec.com/hsl.docs/POWERGRID%20Infrastructure%20Investment%20Trust%20IPO%20Note-202104281958195424232.pdf

https://powermin.gov.in/sites/default/files/uploads/Publishing_RFP_notification_and_RFP_Documents_for_Selection_of_the_TSP_for_establishing_transmission_system_for_ERGSI_on_the_website_of_MoP.pdf

https://www.pginvit.in/uploads/9c5ee3ef-c184-4c1f-a76d-2fbb65872f9f/Valuation_Report-H1FY25.pdf

https://www.pginvit.in/uploads/ad5260c8-859d-4f92-a569-a6bee9080a13/11._Valuation_report.pdf

https://www.pginvit.in/uploads/4fad1cbc-9452-4f54-81a4-ab1803fd893a/Valuation_Report_H1FY22.pdf

https://www.pginvit.in/uploads/904a1ba4-0d41-41c5-b384-cc81909e4297/Unaudited_Financial_Results_for_Q3_FY_2025.PDF

https://www.pginvit.in/uploads/65c541ef-d28a-412e-aa92-fc870c904b9d/PGInvIT_AR24_Final_compressed.pdf

ChatGPT