Tesla

Understanding Innovation

It is November, so ask me anything and I will sent a video response to you in December , Click Ask

Tesla needs no introduction, below is how they define themselves

Our mission is to accelerate the world’s transition to sustainable energy. We design, develop, manufacture, lease and sell high-performance fully electric vehicles, solar energy generation systems and energy storage products. We also offer maintenance, installation, operation, charging, insurance, financial and other services related to our products. Additionally, we are increasingly focused on products and services based on AI, robotics and automation.

Cars

Electric vehicles (EV) cars is where Tesla is currently a global leader, the have been able to ramp up their production capacity over years aggressively, a 7x in last 6 years

This also shows up in their automotive business revenue which has also gone 4x in last 6 years, the revenue growth is showing signs of tiring we will discuss that later

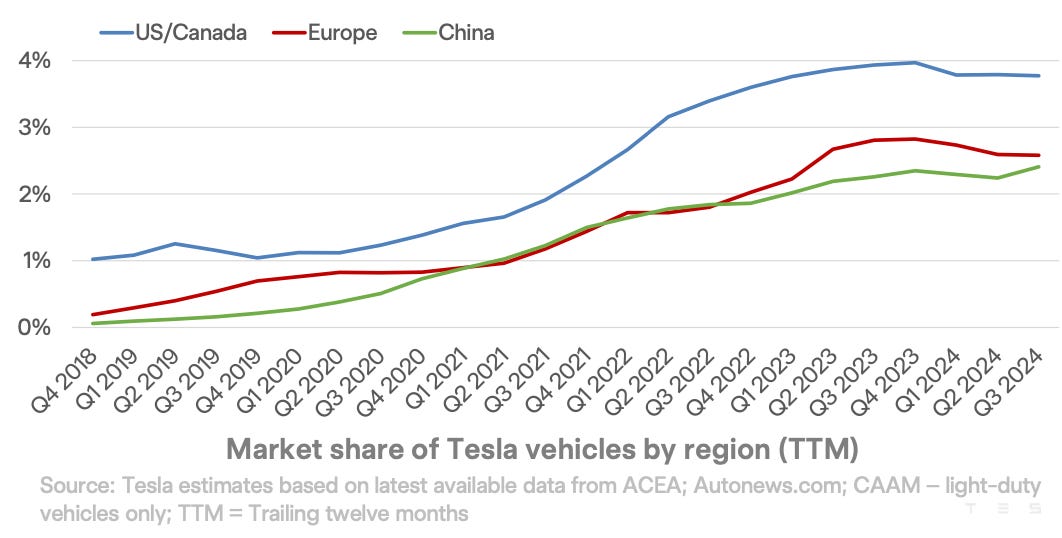

From a global EV adoption perspective , the overall adoption is in upswing. Tesla itself though the largest player in EV its not big from a overall total car market size, accounting for just 4% of overall auto market in its largest market USA1

They want to make buying EV affordable which is evident from numerous price cuts2

Their base model 3 in USA is 40% cheaper than what it was in 2018

However the Chinese competition especially from BYD3 is heating up4

What is Tesla’s strategy to retain and increase market share in Automotive segment ?

Reduce cost and final selling price of their entry level cars so that more people can buy them

Innovate and add more options for their customers, they have been excellent on this front with introduction of new product category every few years as depicted in image below5

Make buying easy with affordable financing/ leasing options

Differentiating with full self driving capability (FSD) , no other car manufacturer is even remotely close to them in this aspect

Creating a new Autonomous Taxi market

The company has currently installed capacity of 3 million vehicle and should not need huge capex in near term on capacity expansion, The management has guided a $10Billion - $11 Billon run rate for capex in next 2-3 years. My estimates are most of it will not be on Automotive business

Anyone tracking Tesla should look at how are they defending against BYD in each of their key markets in Europe, USA and China

Energy

The solar and energy storage business has been a constant ~20% of Tesla’s business from 2018 and has scaled along with its Automotive business, its now contributing significantly to bottom line. They are innovators in this space as well with commerical product like Megapack6 in addition to their retail products

Tesla’s energy storage business is booming, and it is just beginning. However, the beginning of Tesla’s energy storage growth also appears to be the end of Tesla’s solar business.7

In long term we are likely see this continued shift towards energy storage business and as Shanghai Megafactory begins shipping we should see ramp up in this business next year

Megapack alone could contribute 10 GWh of deployment per quarter. Tesla also recently disclosed Powerwall reaching a production capacity of 700,000 Powerwall per year, which can contribute over 2 GWh of energy storage deployment per quarter.

I expect this to be a USD 20 Billion revenue generating division (in 2025) which will continue to grow at fast clip, also USA is building its own solar infrastructure as I highlighted in my note on Waaree8 so this segment definitely has tailwinds

Others

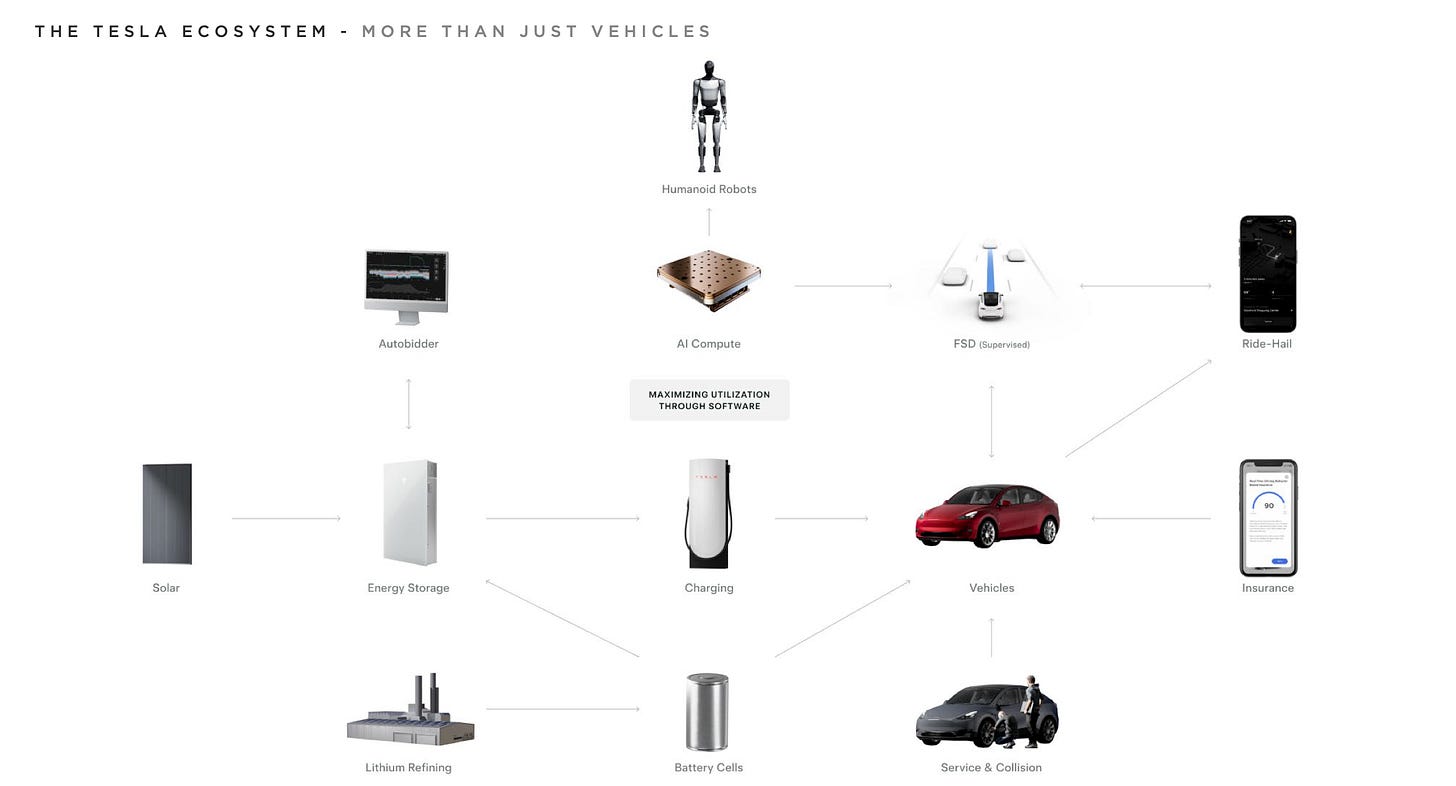

Tesla is promising to build large scale commercially available human like robots9 in it’s ecosystem10

the above image captures Tesla’s flywheel11

Originally popularised in Jim Collins’ book Good to Great, flywheel requires a significant initial push but gains momentum with each turn, businesses can create compounding benefits that feed into one another and accelerate growth.

Human robots is a non revenue generating revenue division of the company, but they have a history of incubating unimaginable products and bringing them to life at scale

Conclusion

Tesla's ecosystem components create a self-reinforcing flywheel

1. Vehicle Production → Data Collection

- Every Tesla vehicle acts as a data-gathering device

- Millions of miles driven provide real-world data for AI training

- Driver behavior, road conditions, and performance metrics are continuously collected

2. Data Collection → AI/FSD Improvement

- Collected data trains Tesla's AI models

- Improves Full Self-Driving capabilities

- Enhances safety features and vehicle performance

- Feeds into machine learning algorithms for continuous improvement

3. AI/FSD → Insurance Business

- Driver behavior data enables usage-based insurance

- Safe driving habits lead to lower premiums

- Real-time monitoring reduces fraud and risk

- Creates competitive advantage in insurance pricing

4. Vehicle + Insurance → Service Integration

- Direct service relationship with customers

- Predictive maintenance based on vehicle data

- Integrated collision repair and parts supply

- Higher customer satisfaction and retention

5. Energy Products → Grid Services

- Solar panels and Powerwall create energy ecosystem

- Autobidder software optimizes energy trading

- Grid-scale storage solutions (Megapack)

- Increases renewable energy adoption

6. Manufacturing Integration

- Battery cell production reduces supply chain risks

- Lithium refining ensures material supply

- Vertical integration lowers costs

- Improves production efficiency and innovation

7. Future Expansion

- AI expertise enables humanoid robot development

- Vehicle autonomy leads to ride-hailing potential

- Energy management extends to grid solutions

All of above creates new revenue streams

This ecosystem creates multiple revenue streams while building strong barriers to entry for competitors.

Valuation

Its a publicly traded company , but its hard to put a dollar value against cutting edge innovation , large opportunity size and the value the intangibles like Elon and company culture

Comparing against any traditional metrics the company would come out to be over valued, At 800 Billion dollar market cap in 2024

8 times sales

80 times profits

A FCF yield of less than 2%

On flip side

Toyota sells 10 times more cars than Tesla

Tesla Grid solutions and energy storage business is just starting to scale

Company has an amazing track record of delivering the unimaginable

It could be the first company to bring human like AI to factory and homes

Mr Market provides us opportunity to load up business like Tesla every 2-5 years, when temporary bad time comes like it did in last quarter of 2022 when Tesla was priced 30 times its depressed profits we could have batted well.

I have a position in Tesla via FANG ETF, this note was to written to expand my knowledge of business and its not a recommendation to buy

I try and end every post with something from gallery

https://digitalassets.tesla.com/tesla-contents/image/upload/IR/TSLA-Q3-2024-Update.pdf

https://docs.google.com/spreadsheets/d/1F5IQOynIawoXiJPVarLDgPQDJAdzY8b5Vamw-Vf3eSY/edit?gid=779648749#gid=779648749

https://www.investors.com/news/tesla-vs-byd-ev-sales-robotaxis/

Notes:

BYD Total NEVs includes both Battery Electric Vehicles (BEV) and Plug-in Hybrid Electric Vehicles (PHEV)

https://en.wikipedia.org/wiki/Tesla,_Inc.

https://www.tesla.com/megapack

https://electrek.co/2024/10/25/teslas-energy-storage-business-is-booming-but-solar-is-gone/

https://digitalassets.tesla.com/tesla-contents/image/upload/IR/TSLA-Q1-2024-Update.pdf

https://www.viima.com/blog/flywheel-of-growth